Not sure where to even start?

Then this is the place for you.

You can create a test ACH/Nacha file for your bank in 4 easy steps:

1. Create a new account in ACH Universal

2. Complete the ACH Setup (gear icon)

3. Import and Map an Excel or csv file

4. Create an ACH file

For those who prefer to watch videos to 'Get Started', please use these links:

Getting Started with Excel Part 1 (3m 54s)

Getting Started with Excel Part 2 (3m 26s)

Working with Profiles (4m 36s)

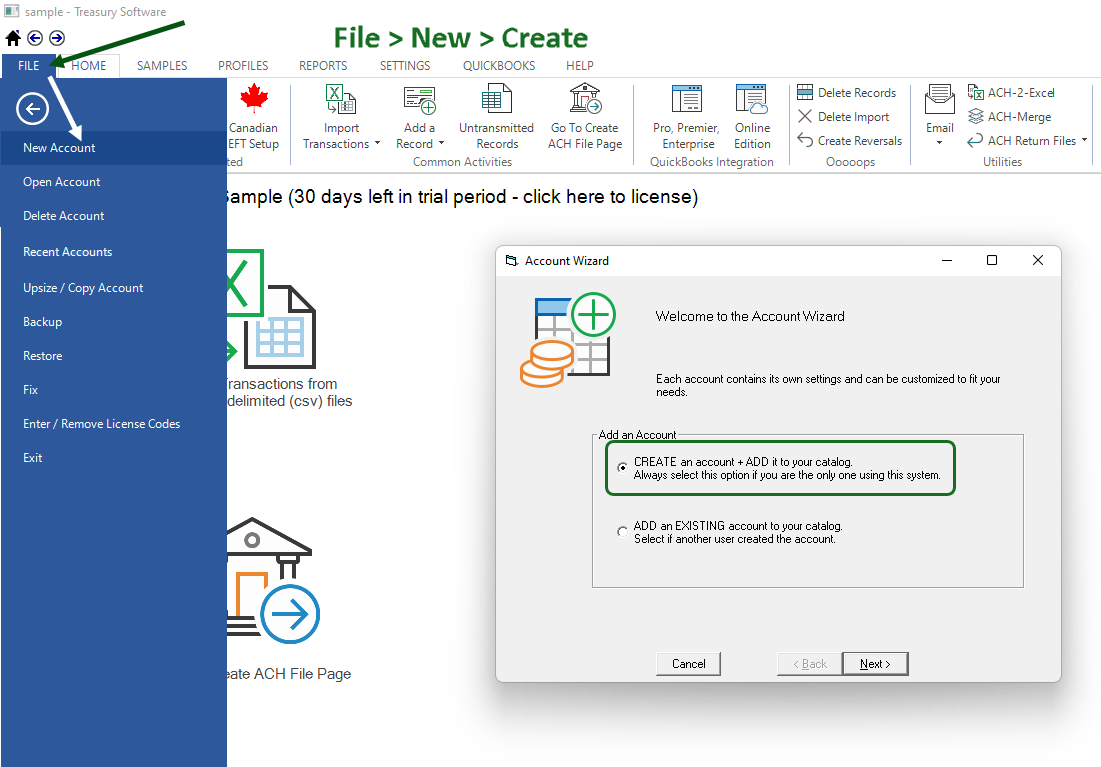

1. Create a new account in ACH Universal (File > New > Create)

Click on the blue 'File' tab >New Account > 'Create an Account'.

Note: If you will be setting up on a multi-user platform, you will want to hold off creating your production accounts until you have connected to the SQL backend. See the SQL instructions for our

Workgroup (SQL Express) or Enterprise (SQL Server) platform.

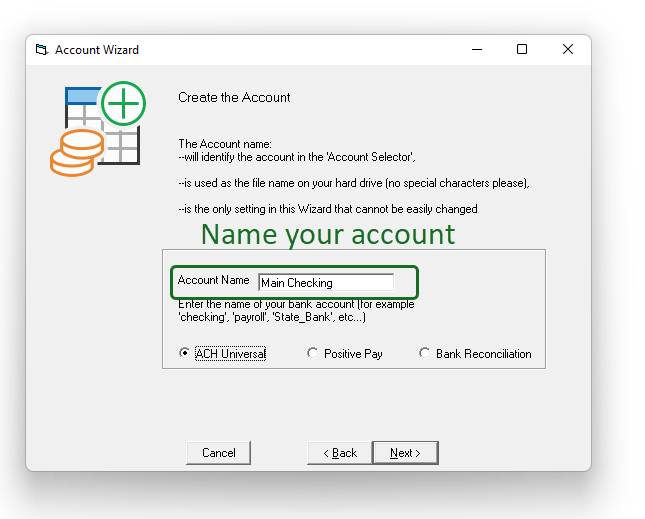

Then enter a name for your account. You will want to be able to identify the bank account name (e.g., Operating or Payroll). Click Next, then Finish. The software will open into the new account.

If you will be originating ACH transactions from more than one bank account, you will want to create a new account (i.e., new database) in our software for each bank account originating ACH files.

(See also Multiple Origination, covered separately, if working with numerous bank accounts.)

Congratulations. We'll be working in this account going forward.

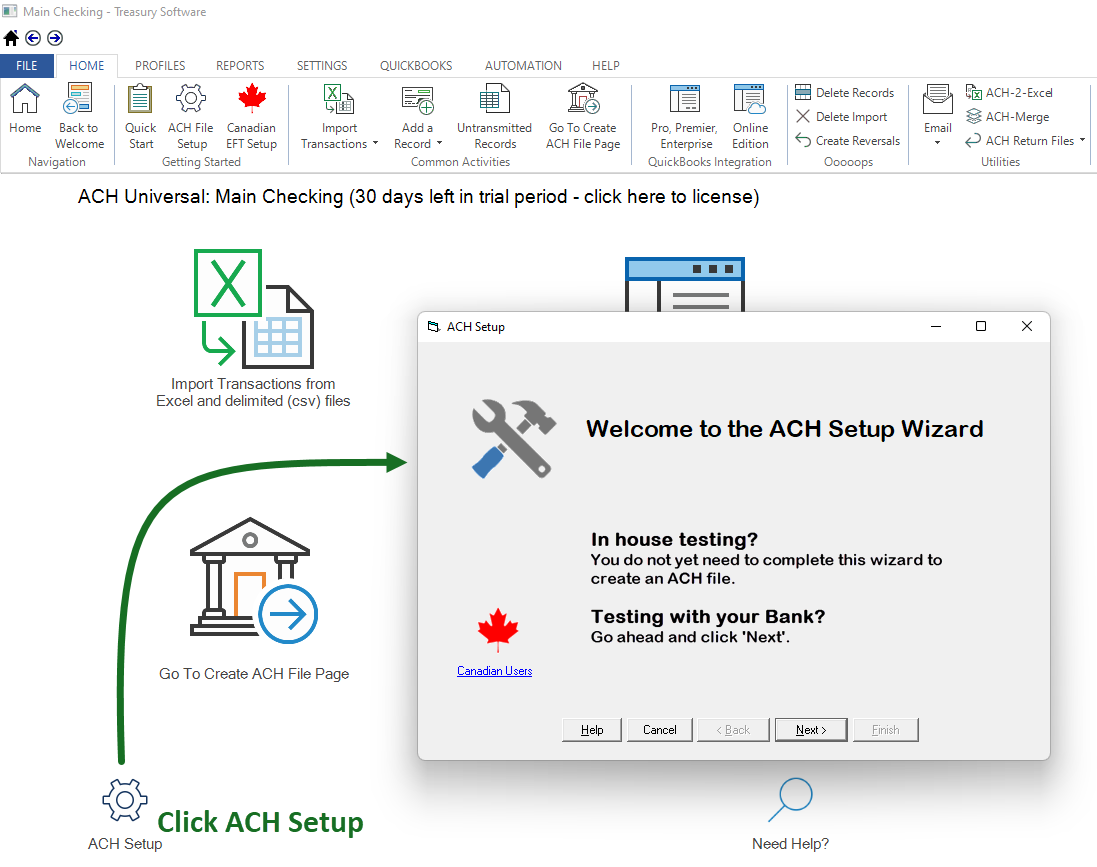

2. ACH File Setup

If you will be testing with your bank, you will need to perform this step prior to creating the files that you send to them.

If you already signed up with your bank for ACH service, this information will be in your Welcome packet. If you have not signed up for ACH Service, you will want to contact the Treasury Management Department at your bank to start the process.

If you have been creating ACH files, but do not have the original documentation from your bank, ACH Universal can pull the Setup information from an ACH file that you have already created.

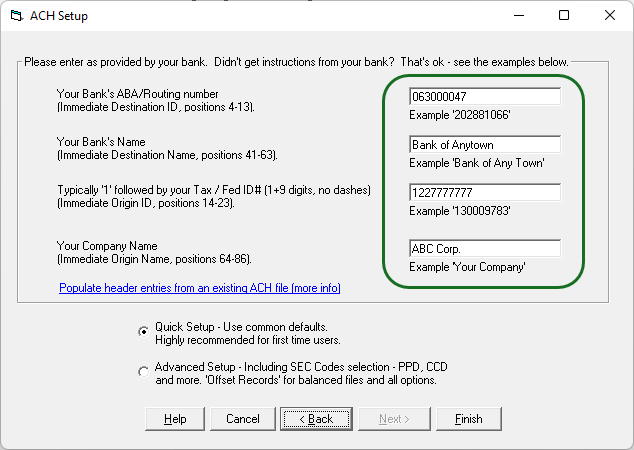

If you are unsure of the information required, follow our guidelines within the wizard below. Of course, we can't guarantee compliance with your bank, but it is a conservative approach to create a test file.

NOTE: If working with a smaller bank or credit union, you may need to set up this page differently as the file will be passed (by your bank) to the Federal Reserve Bank for processing. Ask your bank representative.

Most (basic) users can click 'Finish' to complete.

However, if any of the following apply to you, you will want to click the 'Advanced setup' radio button and then 'Next':

--If using an SEC code other than PPD (such as CCD)

--If creating an offsetting record (i.e., balanced file).

Be sure to click 'Next' until 'Finished'.

3. Importing and Mapping an Excel or csv file

Obtaining Import Data

Before importing a transaction file into ACH Universal, you can create a master Excel or csv import template, or obtain data from your accounting package. Typically, you will run an appropriate report for a given date range from your Accounting system and then save this report to an Excel spreadsheet or csv file. At a minimum, you will need the

--Name

--ABA Routing Number

--Bank Account Number and

--Amount

What if I can't create an Excel or csv file with the four fields above?

No worries - you can create profiles in ACH Universal and store the banking data for your customers, employees and vendors.

See 'Profiles'.

Importing Transactions

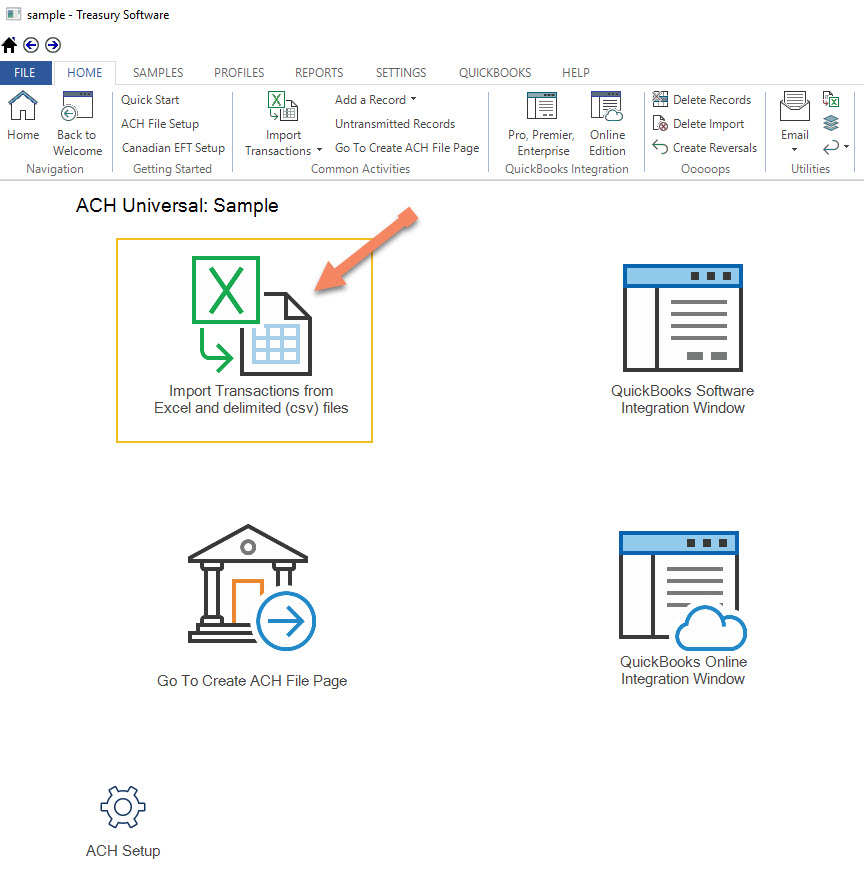

Click on Import Transactions from the icon in the center of the homepage.

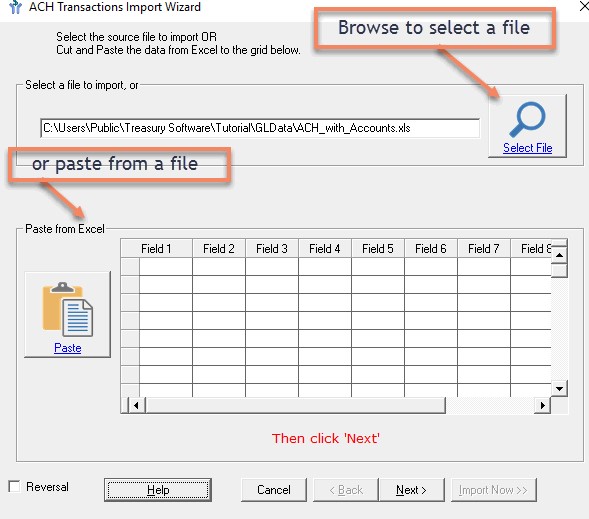

Browse to select a file, or 'copy and paste' the fields with data from Excel/csv.

Important: If you are selecting an Excel file - please confirm that the file is not open in Excel.

Tip: Browse to select a file is much faster and efficient for large imports.

Click Next.

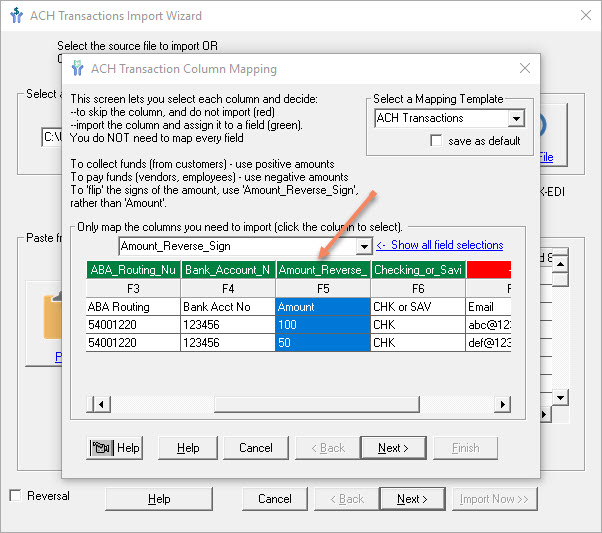

Mapping

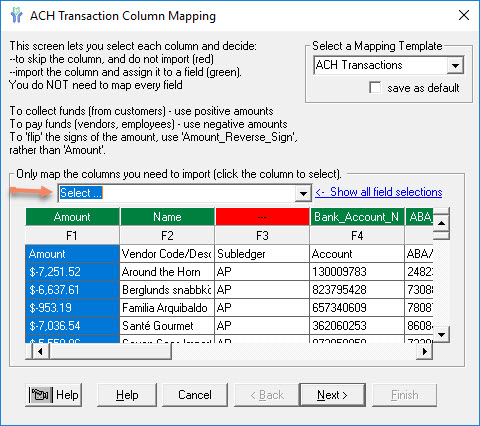

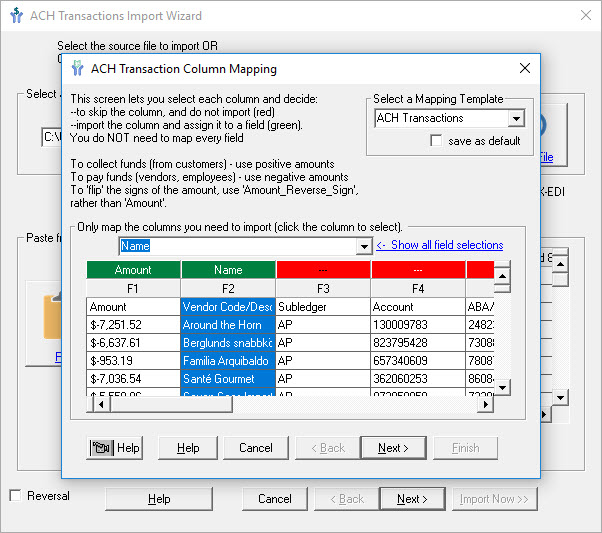

Initially, none of the columns are mapped - the column headers will be displayed in red.

As you map each column, the mapped name will appear with a green header.

In a typical scenario, you will need to include and map the following fields (in no required order):

•Name

•Bank_Account_Number

•ABA_Routing_Number

•Amount or Amount_Reverse_Sign*

•Checking_or_Savings (optional)

Amounts

*Negative amounts decrease your balance, and represent payments out to employees or vendors. Positive amounts increase your balance, and typically represent collections from customers.

If you are making payments out (e.g., to vendors or employees), and the Amounts on the spreadsheet are positive numbers, you will map the column 'Amount Reverse Sign' to turn them into credits. Payments out must be credits.

In addition, you may want to add:

•Date (Mapping a Date will override the default date of 'Next Day'.)

•ID_Number (Some banks require an ID Number)

•ACH_Email_Address (The Email feature requires the Corporate or Advanced edition.)

When all the necessary columns are mapped, click Next to continue through the Import Wizard.

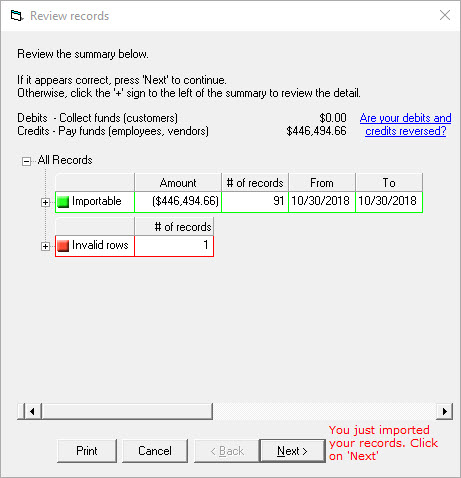

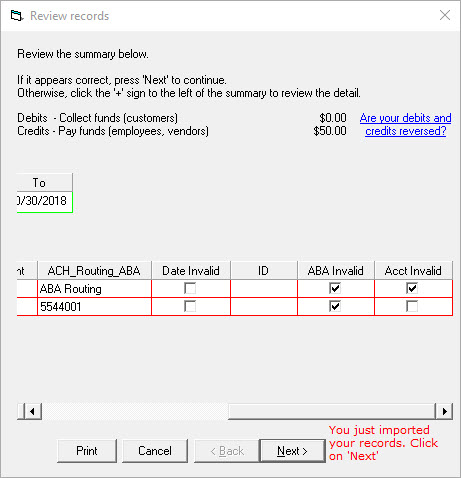

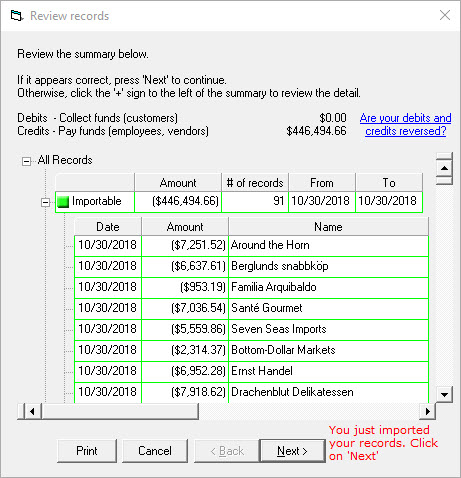

Review Records

This screen will display a list of the importable rows and invalid rows.

Please confirm your control totals and counts.

To review the list of Importable or Invalid Rows, click on the “+” sign as shown below.

The Invalid Rows section will list all rows that will not be imported into ACH Universal. The software will automatically mark header rows, footer rows, summation lines, and blank lines as invalid. For each row that is invalid, a check mark will be placed in the appropriate column indicating why the row was invalid. In the case below, the records were Invalid because the system detected that one was a summary row and the other was a header row.

If a transaction is shown as invalid, you may see that the ABA number is incorrect, for example.

The grid will display the importable transactions and the basic information.

Once you have verified the importable information is accurate, click Next. If you wish to Cancel the import process and try again, simply hit Cancel.

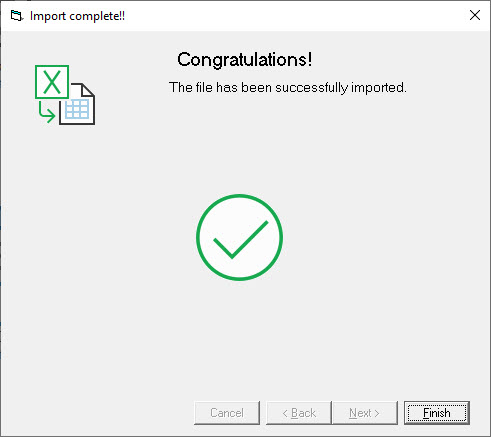

Click Finish to complete the Import Wizard.

You have finished the first step of bringing in the transaction data for the ACH file.

4. Create an ACH file

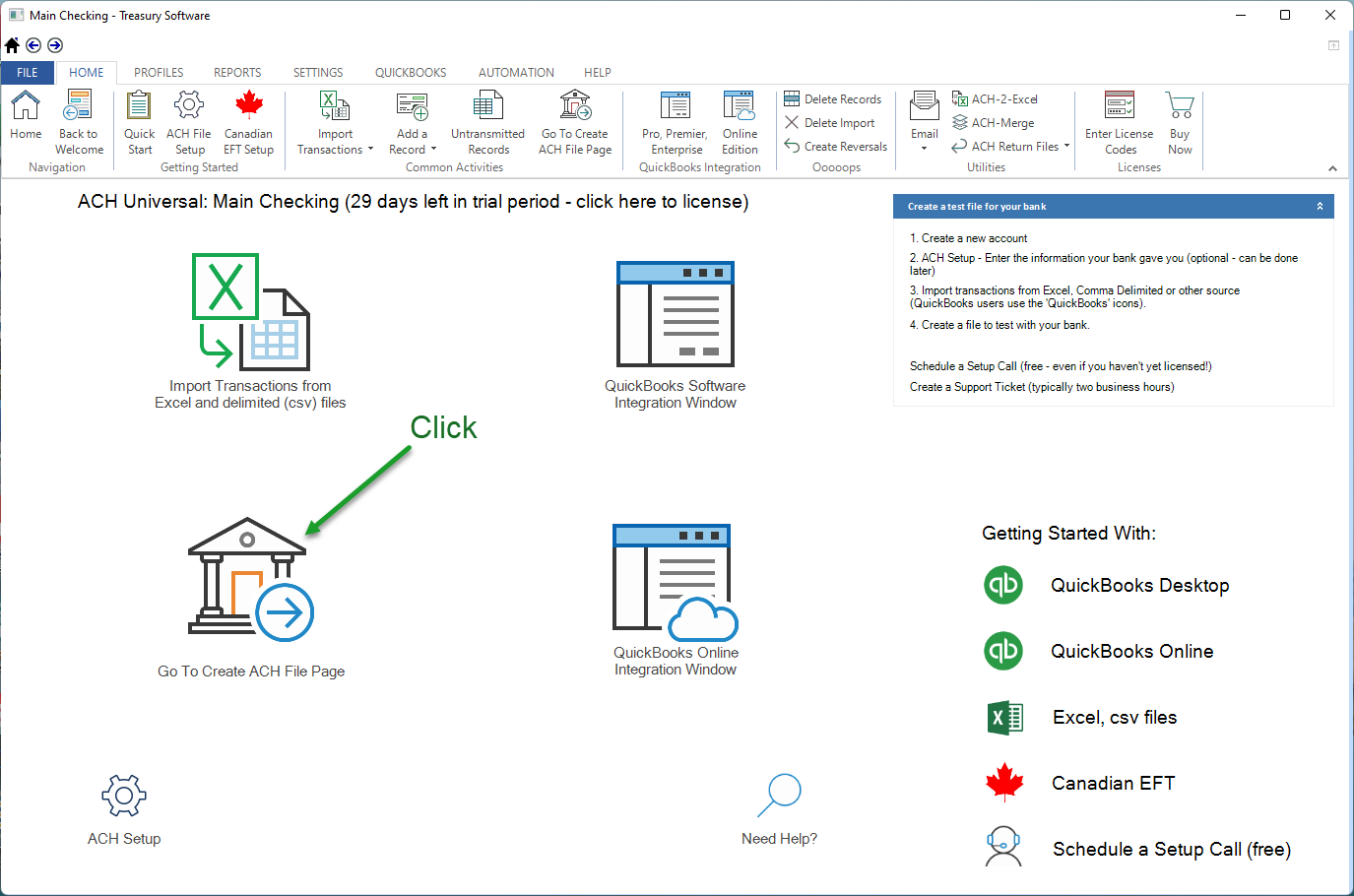

You are now ready for the final step: creating the ACH file and transmitting the file to the bank.

Navigate to the 'Create ACH File Page' by either clicking on the icon in the ribbon bar - or the large icon below.

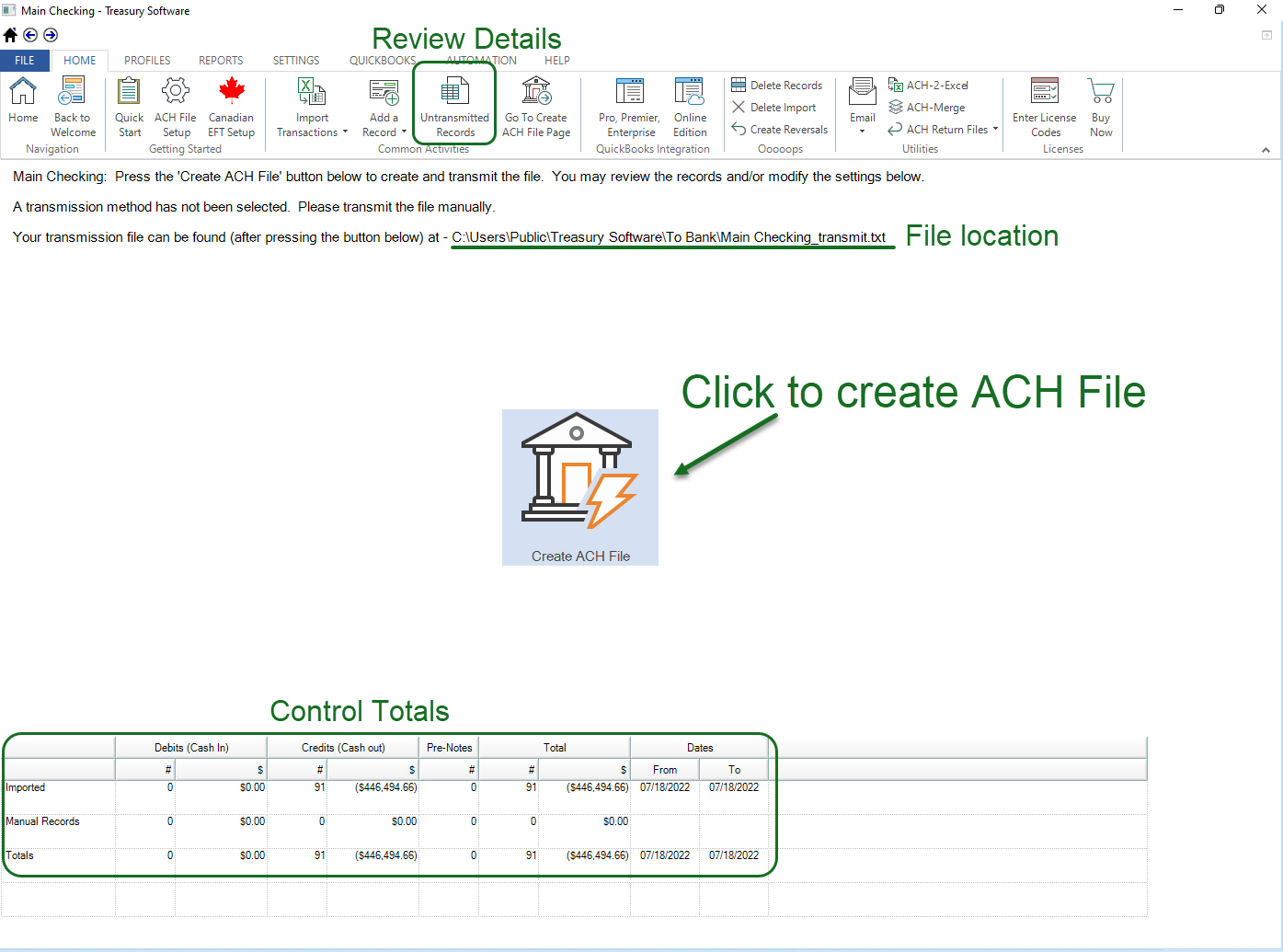

Below is the Create ACH File page.

You can review the control totals and/or record details on this page - and can review detail records if you choose by running the 'Untransmitted Records' report.

The software will also display the location of where the file will be saved.

When ready, click 'Create ACH File' to create the file.

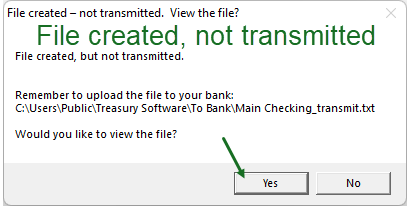

Once you click on Create ACH File, ACH Universal will ask if you want to view the file (click 'yes').

Please remember, the file will be saved locally but, by default, the file has not been transmitted.

In most cases, you will upload your text file to your bank through their website.

Your bank will provide you with instructions for transmitting the file.

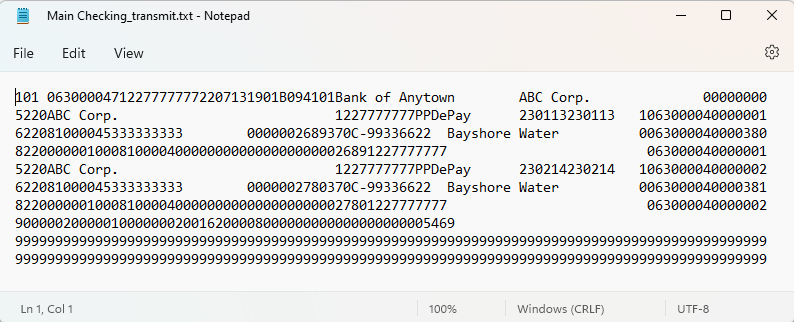

This is an example of an ACH/Nacha file.

Note: If you skipped the ACH setup, you'll see 'OPEN ITEM' within the file - do not send it to the bank.

Remember to upload the file to your bank.

By default the file will be located in the folder:

C:\Users\Public\Treasury Software\To Bank

If you want to store the file in a different location, from the 'Create ACH File Page' icon, you can change the default location by clicking on the far right blue bar 'Change File Name/Location' and pointing the software to a different folder.

Need help or want to schedule a call to get setup?

Click here to schedule a Zoom setup call.