ACH Universal supports the CPA Standard 005 format, which is accepted by all major Canadian banks.

Please note that this format differs from US-based NACHA (ACH) formats.

Canadian vs US processes

Unless noted otherwise, all processes are the same for the two formats. Please follow the same instructions and videos as the NACHA format.

All major functions of ACH Universal that are used to create US-based files, are also available to create Canadian based files. This includes:

--Excel and csv file import, and profile-based import

--QuickBooks integration

--Email notification

--Security features including encryption, web and/or SSH transmission and SQL Server support

--Automation - Software Integration Kit

Notes:

--The CPA005 standard is a one account standard, therefore our multiple origination account format is not applicable.

--The CPA005 does not include a checking/savings account indicator. Therefore, you do not need to map/include this field.

--The CPA005 does not support EDI (ACH-CTX).

--The routing number in Canada must appear as a 9-digit number in ACH Universal. If the Institution is only a 3-digit number, you'll add a leading zero.

Example:

When to use this format...

Please use the CPA-005 if:

--Your bank is a Canadian bank and

--You are originating transactions from that bank--and the other party (i.e., customer, employee, vendor) has a Canadian bank account.

Do not use this format for cross-border transactions.

For example, if you bank with a US bank and the other party (i.e., customer, employee, vendor) has a Canadian bank account, do not use this format.

Instead, please use the NACHA (ACH) format, with an International (IAT) Standard Exchange Class.

Supported banks:

- Royal Bank of Canada (RBC)

- Toronto Dominion (TD)

- HSBC

- Scotiabank

- Bank of Montreal (BMO)

- and all other Canadian Banks accepting the CPA 005 1464 byte file format

For additional reference, The Canadian Payments Association standard CPA-005 is located at:

https://www.cdnpay.ca/imis15/pdf/pdfs_rules/standard_005.pdf

Creating CPA-005 1464-byte files for Electronic Funds Transfers (EFT)

1. Create a new account within the software

Click File > New Account and complete the Wizard.

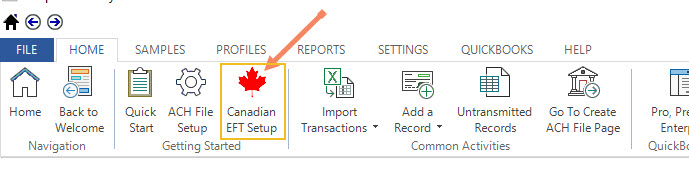

2. From the Home page, click on the Canadian Format button.

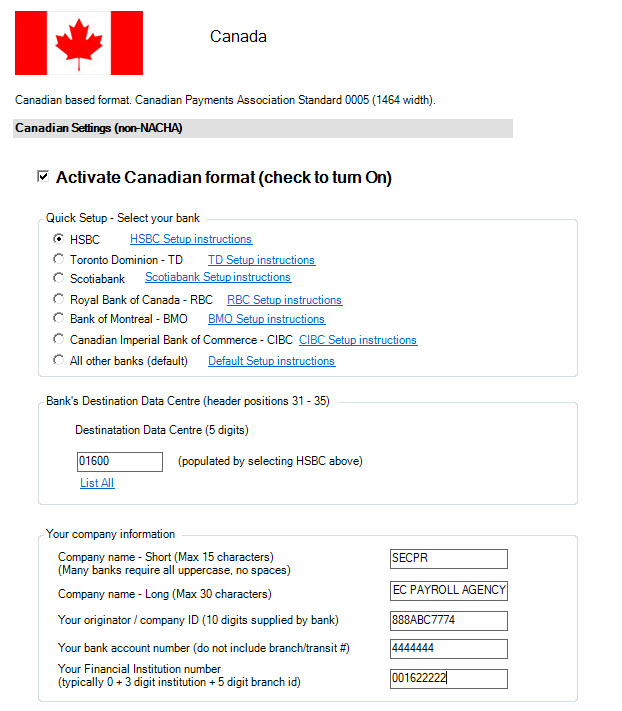

3. Complete the Canadian Options panel

Click on 'Activate Canadian format', then click on your bank and select a five digit Institution ID.

If your bank is not listed, select 'All Other Banks' and continue.

Enter your company information as requested and then click OK.

Be sure to click 'OK' at the bottom of the page when completed.

Notes:

--It is very unusual for you to need to adjust the settings in the 'Bank and Over-ride codes' section.

--Enter a short (abbreviated, up to 15 characters) company name as well as a long company name (up to 30 characters) as either may be displayed on the other party's bank statement.

FAQ's

Should I enter any information within the ACH File Setup Wizard (7 screens)?

No, you will not need to enter any data in the ACH File Setup. This is for the U.S. format only. Please leave the settings at their default settings, and any entries empty.

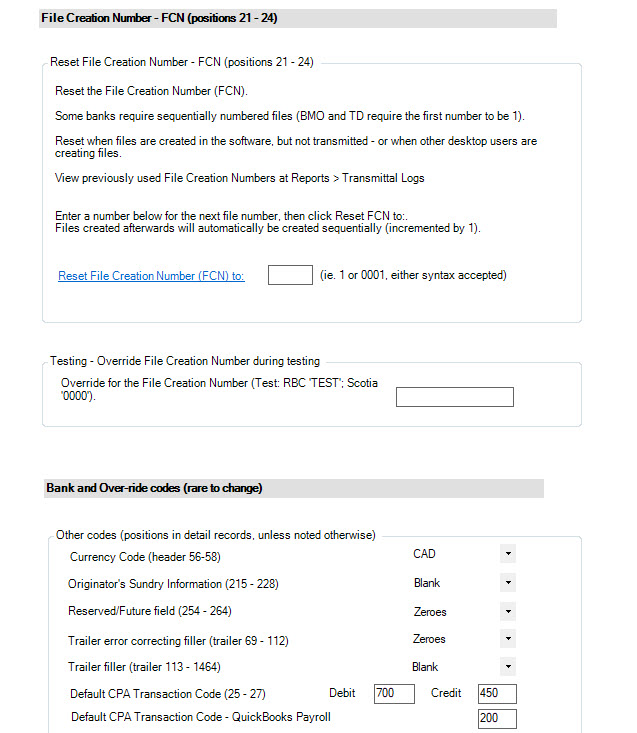

Testing with my bank - any special settings?

Yes, please enter the following into the 'Over-ride for the File Creation Number' field (do not enter the apostrophes):

RBC, enter 'TEST'

Scotiabank, enter '0000'

First time creating a file to be sent to the bank - any special settings?

Yes, please enter the following into the 'Override for the File Creation Number' field:

TD, enter '0001'

BMO, enter '0001'

After you've created the files for the above scenarios, delete the entry from the 'Over-ride for the File Creation Number' field.

Click 'OK' when you're all set.