Depending on the data available to create the Excel or CSV file, you'll either

I. Simple Import - All banking information is in the Excel/CSV file, not using profiles

or

II. Import Using ACH Universal Profiles - The banking information is not in the Excel/CSV file

I. Simple Import - All banking information is in the Excel/CSV file, not using profiles

This is the easiest and most popular method of creating transactions for customers, employees and vendors.

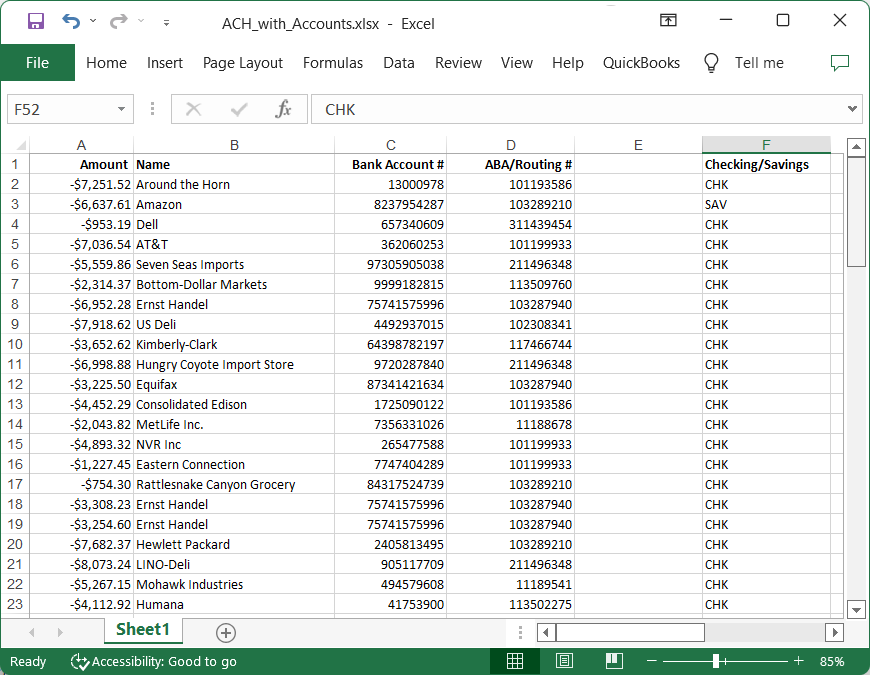

You should be able to create an Excel or CSV file that contains:

•Name

•Account number

•ABA/Routing number

•Amount

•Checking or Savings indicator (optional)

These fields contain enough information to generate an electronic payment or electronic collection. If your data resembles this format, follow instructions for "On-the-Fly" or "Ad Hoc" file Imports.

Additional fields of information can be in your source document and excluded from the ACH file (such as address, phone numbers, etc.); or, you may want to include additional fields of data, such as Date or ID Number..

The order of the columns is not significant

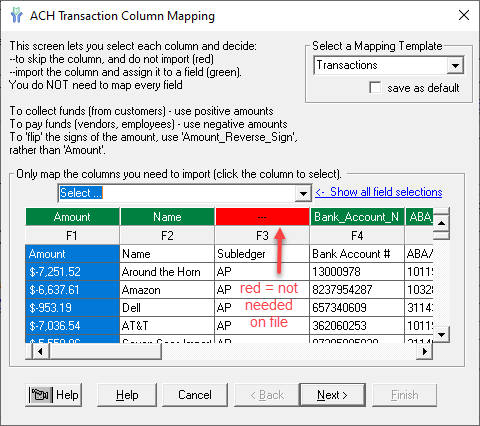

ACH Universal has a mapping wizard. When importing a file, you'll map the column headers to identify the data in each column. This turns the column header from red to green.

If all of your transactions are to/from checking accounts, you do not need to map a column for Checking/Savings. The system will automatically default to checking.

If your transactions are mixed between checking and savings, you'll want to include a Checking/Savings column for this with field entries CHK or SAV (or C or S).

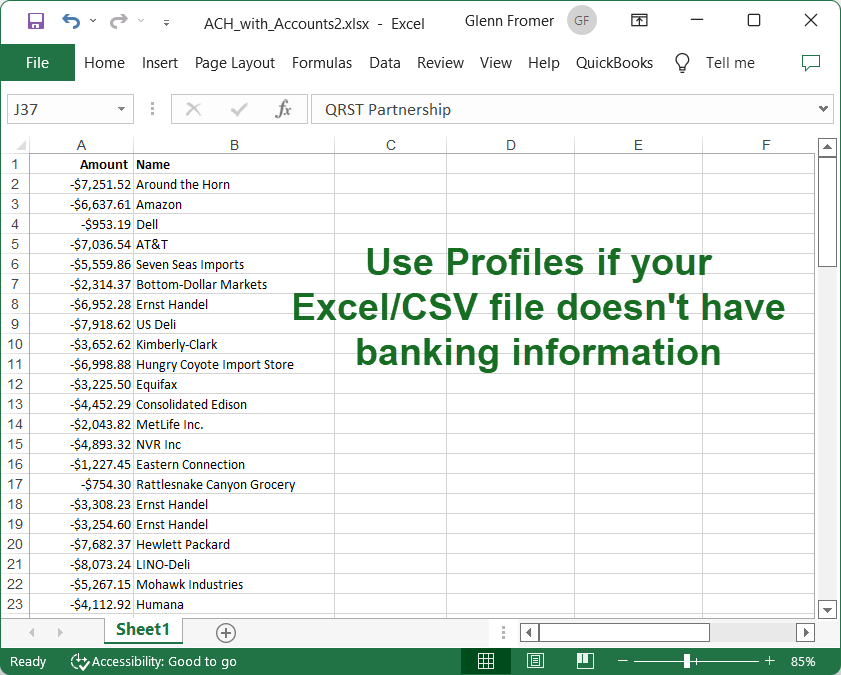

II. Import Using ACH Universal Profiles - The banking information is not in the Excel/CSV file

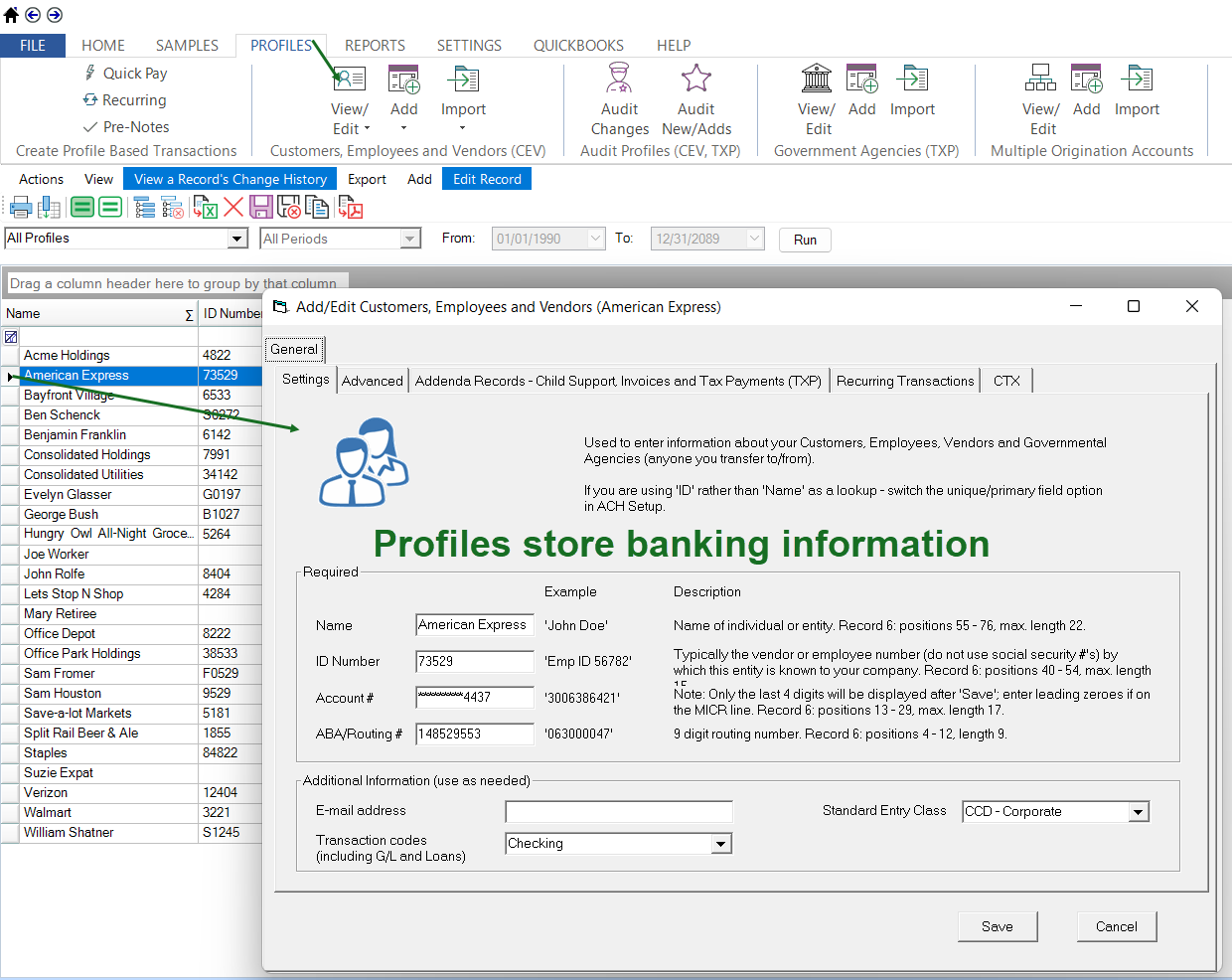

The ACH recipients that are stored in ACH Universal are called 'Profiles'.

Profile-based "lookups" are excellent for off-the-shelf accounting packages that do not have the ability to store bank account and routing information. Or, if you are paying or collecting from the same Profiles on a routine basis, you may want to store the information.

In this scenario you would create Profiles for each of your Customers, Employees and/or Vendors in the ACH software. You have the option of importing a file of Profile information, or adding one at a time. Profiles are retained once 'Saved'. [Note: You'll refresh the screen to see recent additions or changes.]

Profile-based imports make the transaction file very simple. The only fields required are an amount and a lookup field, which is either a Name or ID Number.

See Profiles for detailed by step help at:

https://help.treasurysoftware.com/hc/en-us/articles/360010353973-Creating-and-Using-Profiles

Should I Use Ad Hoc or Profile-Based Importing?

The resulting ACH file will be exactly the same regardless of import method. If you choose to store Profiles in the software, they will be available so that you do not need to include all bank information on your import file.