Multiple Origination Accounts - QuickBooks Integration

What is an Origination Account?

An Origination Account is a bank account that you own (or control), that you send payments from, or where incoming funds are collected.

For example, a company's payroll account that is set up for ACH service would be an Origination account.

How do we work with more than one account?

There are two ways to work with Multiple Origination accounts:

- We are a large company and have two Origination accounts--one for payroll and one for vendor payments (A/P).

- We are a payroll processor and work with several QuickBooks companies.

To set up Multiple Origination accounts using QuickBooks Integration:

1. Open up the first QuickBooks company file, login as the Admin*.

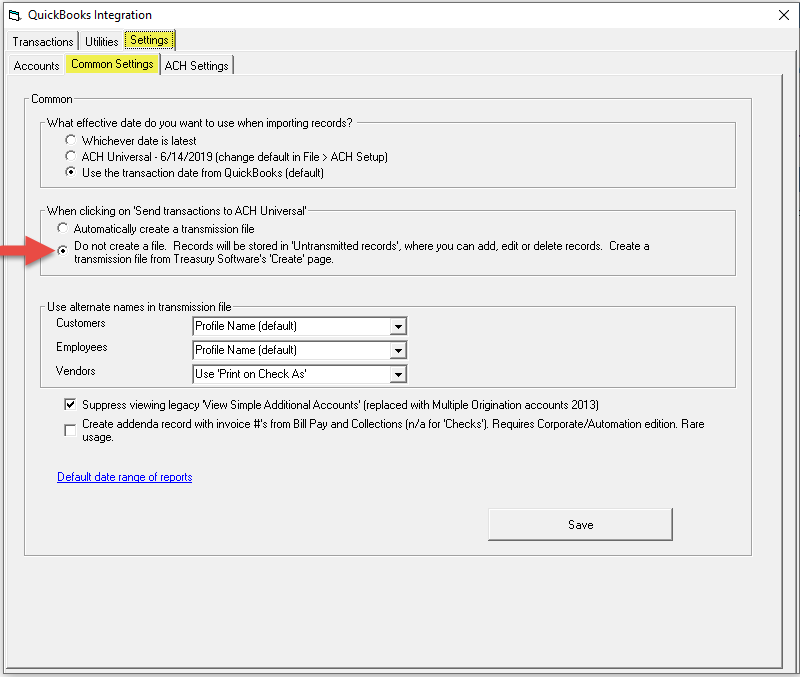

2. In Treasury Software, click on QuickBooks integration > Settings tab > Common Settings >choose 'Do not create a file' radio button. Click 'Save' and once the integration process is complete, close the QuickBooks integration box.

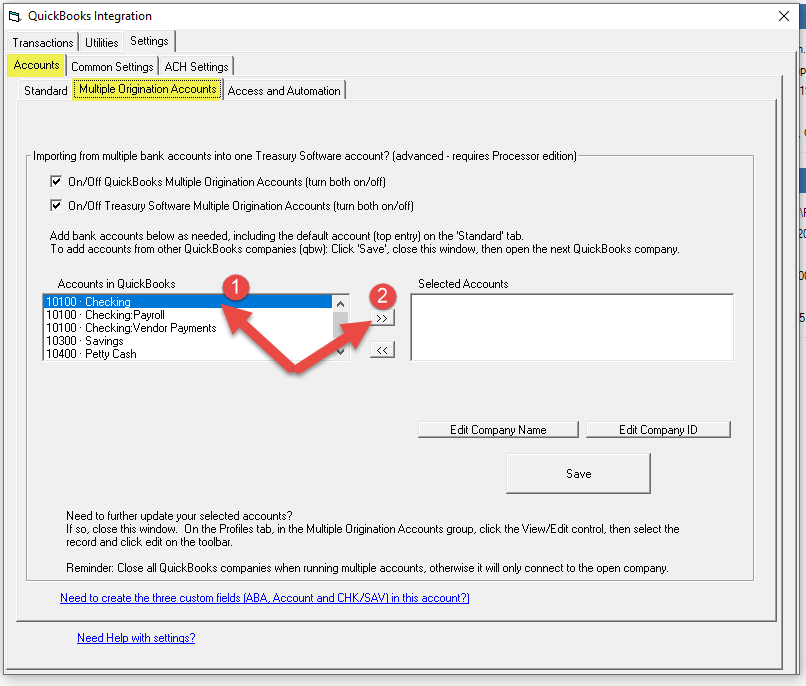

3. Next, in the same QuickBooks integration window, select the Accounts tab > Multiple Origination Accounts tab > check both check boxes to turn on Multiple Originations.

4. While still on this Multiple Originations Accounts tab > select the first bank account > slide it over to the right box.

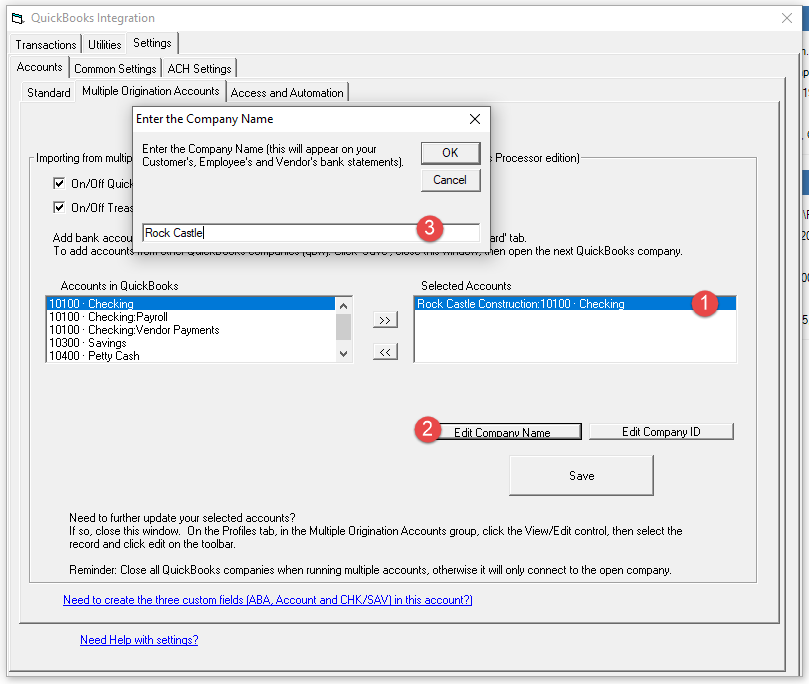

5. Click on the 'Edit Company Name' (give it a short name) and 'Edit Company ID' (usually Federal ID) to update these fields.

If choosing a second bank account within the same QuickBooks company file: Repeat Steps 4 and 5.

6. Click Save and close the QuickBooks integration window (not the software).

If choosing a second QuickBooks company account:

7. Close the first QuickBooks company file and open up the next the next QuickBooks company file.

8. Repeat Steps 4, 5, and 6.

When you are ready to import QuickBooks data and create a file:

1. Open up the QuickBooks company file > QuickBooks Integration > 'View Transactions' > enter the date range > 'Send Transactions to ACH Universal'.

2. If using a second QuickBooks company, close the first QuickBooks company file and open up the next. Repeat Step 1.

3. Once all the data has been imported, select the icon 'Go to Create ACH File' > 'Create ACH File'.