Mapping overview

Bank Reconciliation conforms to your data, not the other way around. In the mapping process, you tell Bank Reconciliation what each field of your data represents. This process only needs to be performed once for each unique layout of your data.

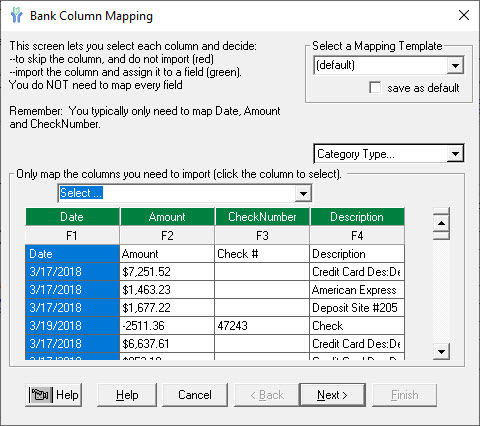

You can use the default template or one of the other 'user-defined' mapping templates.

Before you begin

Required:

1.You have created your own Account (not using the Sample account).

2.You have already imported your bank or general ledger data.

Why do I map the data?

Mapping translates your internal data name into a name the software knows. Without this step, the software will not know, for example, if a field holds a transaction date or check number.

Choosing fields

For the majority of cases, the mappings below are suggested.

At a minimum, files sent to the bank will include: check number, amount, date, usually the payee name, and sometimes a void indicator. Perform these mappings as follows:

|

Field From Data |

Bank Reconciliation field |

|

Check number |

CheckNumber |

|

Amount |

If amounts in file are positive and all checks are issued checks - use 'Amount_Reverse_Sign' as the column header If amounts in file are negative and all checks are issued checks - use 'Amount' If amounts in file are both positive and negative but signed correctly - use 'Amount' |

|

Date |

Date |

|

Payee name |

Description |

|

Void check indicator |

Void_Check_Indicator |

See 'Mapping General Ledger Data' for the steps to actually create the mapping.

In Bank Reconciliation, you will have two kinds of data: bank data and general ledger data. You must pay special attention to how the amounts are listed. In some cases, the bank data will have two columns, one marked Debit and one Credit, while other times the amounts are in one field and signed. Special care must be taken as positive and negative values have different meaning to the bank than to your company.

For Debit/Credit mappings, please see the article 'Debit versus Credit'.

For amounts in one field, it is important to know that Bank Reconciliation views all negative values as being ones that reduce your general ledger, such as payments and issued checks, while positive values increased your general ledger, such as deposits and void checks. If this is accurately represented in the bank data, map the amount as Amount. If the signs are exactly the opposite, map the amount as Amount_Reverse_Sign. See 'Selecting Fields to Represent Amount' for more information.