Note: CTX requires ACH Universal's Advanced (Processor) edition

Create an Account

The first step in using ACH Universal is to create an account to hold your imported data. It is recommended you create one account for CTX-only transactions and one account for all other transactions.

Create an account by selecting from the main menu File > New Account.

ACH File Setup

Then, in the ACH Setup Wizard (lower left corner of ACH Universal), clicking through the 'Advanced Setup' to get to screen 4 of 6, you will see the area for Standard Entry Class Code. Select the radio button for CTX-EDI Subsets. In almost every situation you will use EPN STP 820. Make sure it is visible in the dropdown box.

On the final screen (screen 6 of 6), select the CTX tab.

In the first dropdown box, select the method your organization is using to identify yourself at the transaction level. This is decided by your bank. Your choices are: U.S. Federal I.D. number, DUNS (Dun and Bradstreet) number, or DUNS plus suffix.

Setting up a Payee Profile

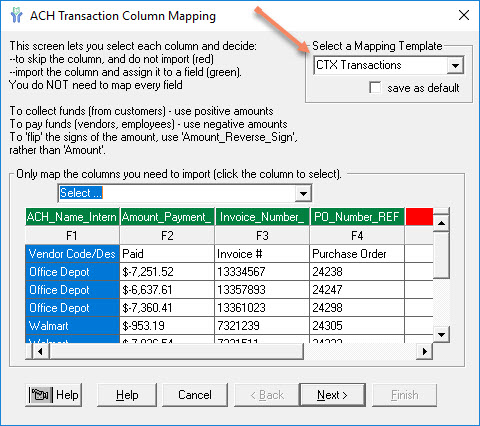

ACH Universal requires CTX transactions be done via profiles. Account and routing numbers for each payee are stored as a profile in ACH Universal and then looked up via Name or ID Number when importing transactional information.

From the main menu select 'Profiles', 'Add/Edit Customers, Employees and Vendors', then click to 'Add'.

Name: Enter the name which will appear on your import file. Example: If you are paying an office supply company and their company name is 'Office Depot', enter that here. (This appears on each line item of the detailed report you are using as an input file) .

Bank Account Number and ABA Routing Number - Using our Office Depot example, enter their banking information here.

ID number - This is for your records. Enter your internal vendor number here. Using our example, it may be 'OfficeDepot001'. Note: Sometimes this entry is simply the same as the Name.

Checking or Saving - Leave as Checking unless instructed otherwise by your Trading Partner.

ID Type and Number - Enter as provided by your Trading Partner.

Origination - Leave blank.

Application - Select 'CTX - Create EDI' if it is not already displayed.

Click 'Save' to close the window and update your modifications.

Why CTX?

CTX, or Corporate Trade Exchange, is a Standard Entry Class code that can contain multiple addenda records which provide additional information on each transaction (also called remittance information, such as invoice numbering).

EDI, or Electronic Data Interchange, is a set of standards governing the structure of electronically-transferred information. EDI provides the engine that structures the transmission of CTX transactions. EDI is standardized under ANSI ASC X12. There are multiple transaction sets available under EDI, the most commonly used through ACH Universal being the EPN-STP 820 set.

CTX specifically defines the structure of the addenda records into segments. This provides ease of processing as well as flexibility in making your payments.