Treasury Software wants our customers to know that we are in compliance with all NACHA rules changes that take place. This includes all rules regarding formatting, files, and encryption requirements.

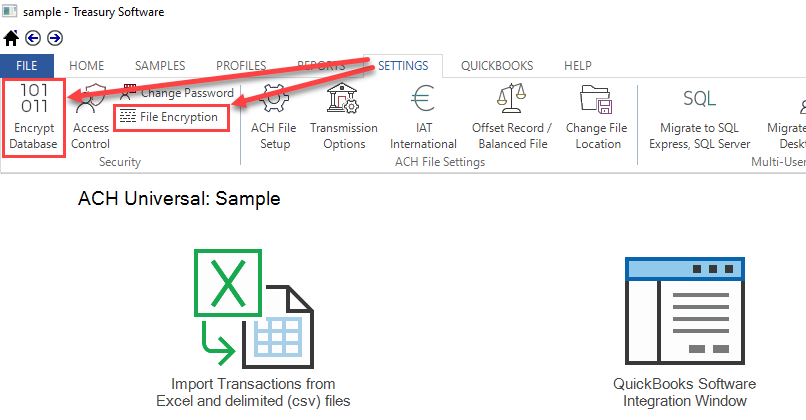

Please note: It is necessary to elect to have the database or ACH file encrypted by going to the Settings tab:

All processing rules changes can be explained by your bank (Treasury Software is not involved in the processing of the ACH files).

_____________________________________________________________________________________

NACHA Rules Changes

Clarifications (Minor topics)

- Effective 09/17/2021

Clarification on SEC Code Flexibility and Subsequent Entries Initiated at Electronic Terminals

-

Aligns rules with existing formatting requirements to convey terminal information, as required by Regulation E

RDFI Subsequent Request for Proof Of Authorization Must Be In Writing

-

RDFIs already must submit the original request proof of authorization in writing; this rules aligns requirements by clarifying that a subsequent request must be made in the same manner.

Stop Payment Rules for Subsequent Entries

-

Mirrors language for stop payment orders on Single Entries

Reversals and Enforcement

- Effective 06/30/2021

The overarching purpose of these two Rules is to deter and prevent, to the extent possible, the improper use of reversals and the harm it can cause.

The two Rules explicitly address improper uses of reversals, and improve enforcement capabilities for egregious violations of the Rules.

Limitation on Warranty Claims

- Effective 06/30/2021

The Limitation on Warranty Claims limits the length of time in which an RDFI will be permitted to make a claim against the ODFI’s authorization warranty. The rule will become effective June 30, 2021.

Supplementing Data Security Requirements (Phase 1)

- Effective 06/30/2021

The existing ACH Security Framework Rule -- including its data protection requirements -- will be supplemented to explicitly require large, non-FI Originators, Third-Party Service Providers and Third-Party Senders to protect deposit account information by rendering it unreadable when it is stored electronically.

Differentiating Unauthorized Return Reasons

- Effective 04/01/2021

This rule better differentiates among types of unauthorized return reasons for consumer debits. This differentiation will give ODFIs and their Originators clearer and better information when a customer claims that an error occurred with an authorized payment, as opposed to when a customer claims there was no authorization for a payment.

Expanding Same Day ACH

- Effective 03/19/2021

This rule expands access to Same Day ACH by allowing Same Day ACH transactions to be submitted to the ACH Network for an additional two hours every business day. The new Same Day ACH processing window became effective on March 19, 2021.

Supplementing Fraud Detection Standards for WEB Debits

- Effective 03/19/2021

The WEB Debit Account Validation Rule became effective March 19, 2021. The rule was originally approved by Nacha members in November 2018 to become effective January 1, 2020.