Overview

The Manual Matching Window provides an opportunity for users to match records that were not matched by an automated matching rule.

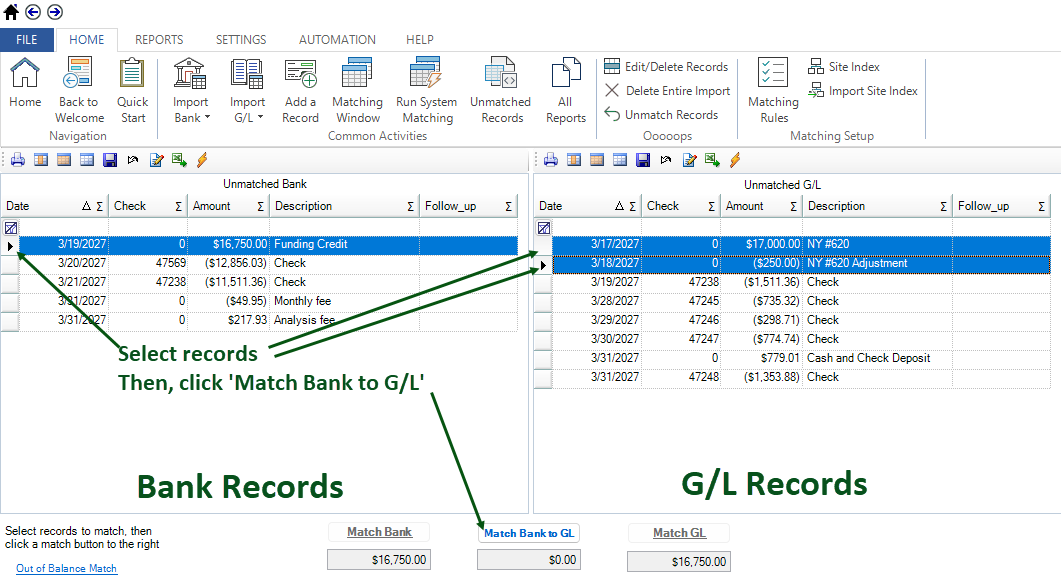

Records are presented in an easy to use side-by-side window, with unmatched Bank records on the left and unmatched General Ledger records on the right.

Steps

Select the records that you want to match, then click on the match button at the bottom.

The left pane holds bank records, the right pane holds general ledger records. Look through the data in each to see if there are any matches.

In the sample, the bank side has a Funding credit for $16,750.00.

If you look on the general ledger side, there appears to be a deposit listed as NY #620 for $17,000.00.

Right below it, there is a record for $250.00, listed as 'NY #620 Adjustment'. Clearly the intent is to make the NY #620 deposit for $16,750.00.

Select each of these records by clicking on them (to select multiple records in the same pane, hold the Control key). They will now be highlighted in blue as shown below.

In the bottom of the screen, notice that you see $16,750.00 in the text boxes corresponding to each pane. The difference between the two, $0.00, is in the middle textbox. To match, click the 'Match Bank to G/L' link. The system will match the records and remove them from the screen.

This matches the Funding Credit record on the bank side. These 3 records (1 bank, 2 general ledger), are a match.

Perform additional matches, as needed.

Notes:

- You can also perform Bank to Bank and G/L to G/L matching.

- You can perform Out of Balance Matching, by clicking on the link in the lower left corner. The tolerance is typically defaulted to $10.00, although it can be modified as needed. A rounding record will be created on the G/L for any out of balance match performed.