Overview

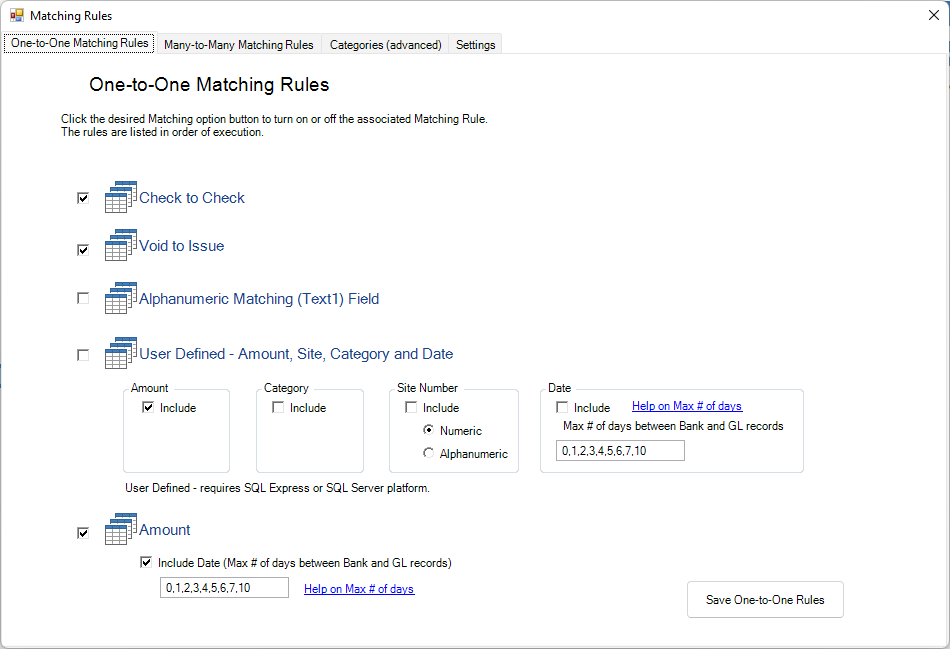

The system comes with predefined high speed matching rules:

- Check to Check

- Void to Issue

- Alphanumeric Matching

- Amount

Check the rules you want turn on.

Rules are run in order from top to bottom

Note: User Defined Matching is covered in Categories.

One to One Matching

Check-to-Check matching

Default: On

Attributes: Records are matched using check number and amount.

The match will be a cleared check from the bank to an issued check on the general ledger.

The sign of the amount of the checks must be the same (negative to negative).

Note: Voided checks are matched using the Void Check rule.

Void-to-Issue matching

Default: On

Attributes: Records are matched using using check number and amount from void check to same fields of issued check. Records are general ledger to general ledger.

This type of matching occurs solely in general ledger data. A check number and amount of an issued check will be matched to a check number and amount of a voided check.

Voided check amounts should be positive; issued check amounts should be negative.

Alphanumeric matching

Default: Off

Attributes: Text in Matching (Text1) Field and amount

Notes:

Alphanumeric Matching uses 'Matching (Text1) Field' and amount to match Bank records to G/L records. Typically the value in the Matching (Text1) is unique, but it is not required to be unique.

For a match to be successful, both records must have the same text in the Matching (Text1) field and contain equal amounts. Both amounts can be either positive or negative.

The records may not contain a check number. If they contain a check number, the records will be matched using the Check rules and not this Alphanumeric rule.

Records with no entry in the Matching (Text1) Field will not be matched by this process.

Tip: If this rule is used, typically the 'Amount' (Amount Only) rule is turned off.

User Defined Matching

Default: Off

See Categories for overview and use.

Amount (Amount Only) Matching

Default: On

Attributes: Records are matched using only amount, with an option to further limit by date.

For a match to be successful, both records must have the same amounts. Both amounts can be either positive or negative.

Notes:

The records may not contain a check number. If they contain a check number, the records will be matched using the Check rules and not this rule.

We recommend using the iterative date match option. This minimizes false (positive) matches when there are duplicate/repetitive amounts in your data sets.

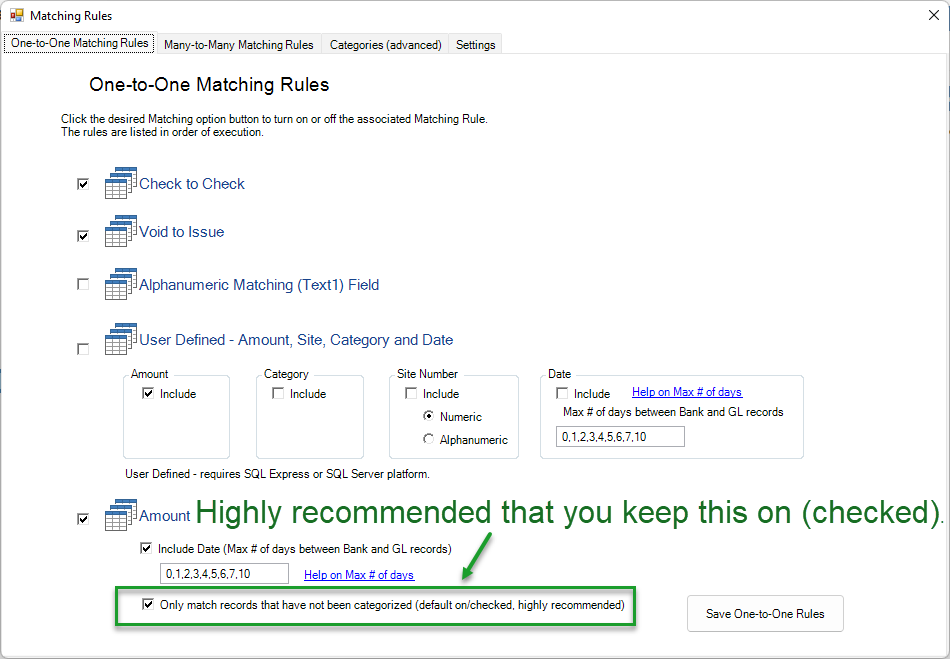

By default, records which have been categorized using a user defined category rule, will not be matched by this rule. We highly recommend you leave this on it's default (on) setting as this will typically suppress false matches. If your use is contraindicated, you may turn this setting off.

Amount Only - Option for Categorized Records

We highly recommend that you leave this option on (checked).

When turned on (checked), this option keeps the intent of your categorizing records.

The purpose of categorizing records is to match them with similarly categorized records.

Unchecking this option will defeat this purpose and enable cross-category matching as well as matching categorized records against uncategorized records.

Example:

For example, if you set up a rule to categorize some records as 'credit card', a bank record categorized as 'credit card' could erroneously match to a miscellaneous deposit if you had this option turned off.

By turning it on, the 'Amounts Only' rule would not perform an erroneous match, or any other cross-category match.