Note: Addenda Records require the Corporate edition license.

You are able to create:

--Tax payments in the TXP10 format, and in any format

Includes Federal, State and local taxes such as cigarette, liquor, lottery and excise taxes.

TXP*651122334*94105*120901*1*300000*2*104400*3*430000*3435\ (941 Federal Payroll)

TXP*651122334*0108M*120901*1*T*23900******YOURCO*120901*3435\ (State Excise Tax)

--Child support in DED/CS formats

DED*CS*FD146*110204*54789*6576562134*N*DOE, JOHN*28001\ (State child support)

--Private sector (vendor) payments in RMR, or any format

RMR*IV*8045551212**34563\ (Telecommunications payment)

656876532*34563\ (Simple account number with payment)

How to create an Addenda Record

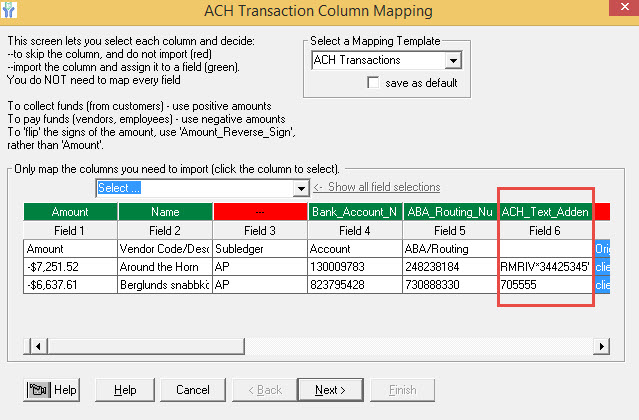

1. If you already created a column of Addenda information on your import file, simply import the addenda information with your data and map the field 'ACH_Text_Addenda'.

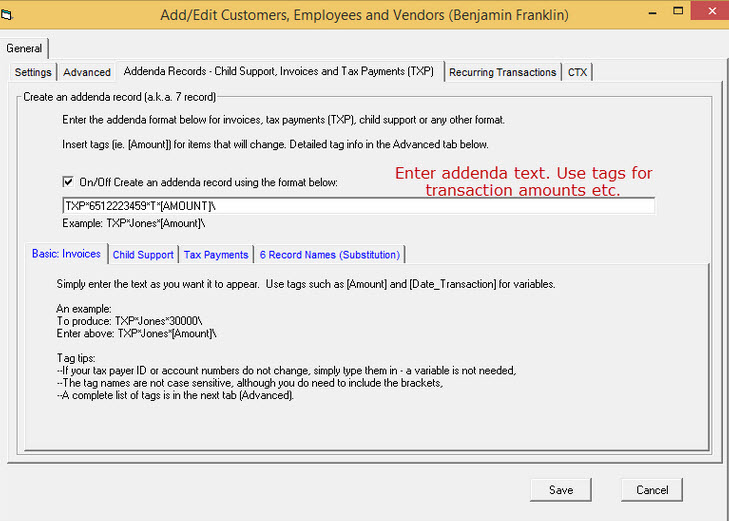

2. ACH Universal can create the addenda record for you if you don't have the data.

In all profiles (i.e., Vendor and Government Agencies), you can enter the layout of the specified format (below). See 'Tax Payments - TXP' for detailed information on TXP and Vendor payments.

3. Need to create a CTX file with multiple addenda records?

See 'CTX' on how to create EDI in an 820 transaction set using our embedded EDI engine.

Note: The CTX feature requires the Advanced (Processor) level license.