The international (IAT) format requires the Advanced (Processor) edition of ACH Universal.

If you are sending or receiving funds from one country to another country (e.g., Canada to the US), you will need to use the IAT format in ACH Universal. (This is based on the source of the funds.)

The IAT Standard Entry Class Code is used for the transmission of International credit and debit ACH entries. The format handles both inbound and outbound (into and out of the US). The format contains extensive detailed information unique to cross-border payments.

ACH Universal has several different methods of creating IAT records, including Point and Click, Simple Import, Complete Import and QuickBooks. Below is our recommended Simple Import method.

Simple Import

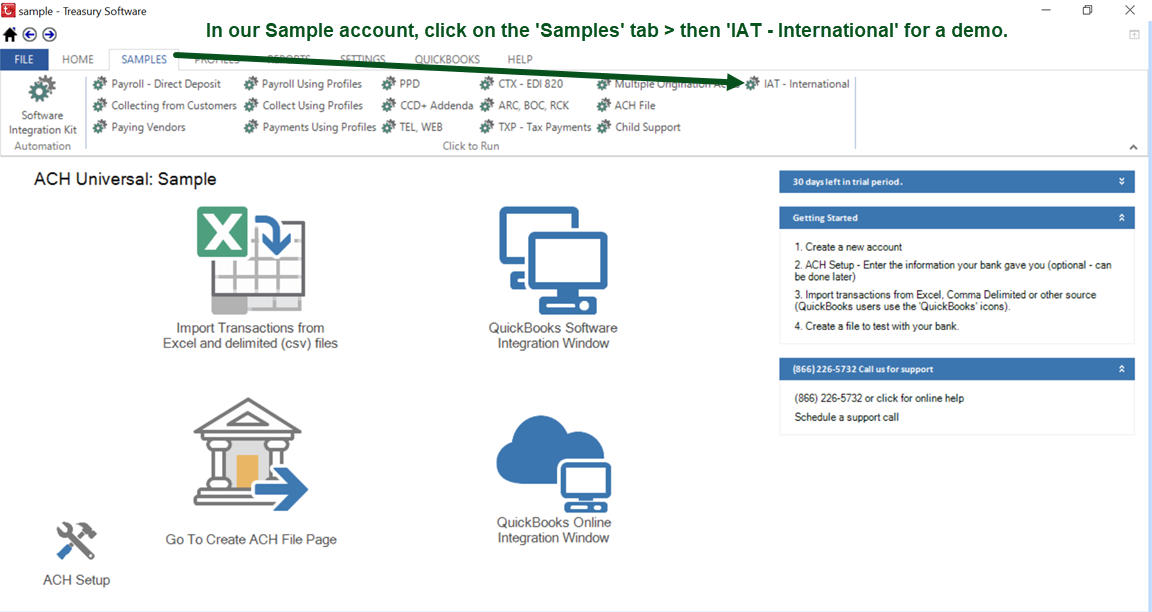

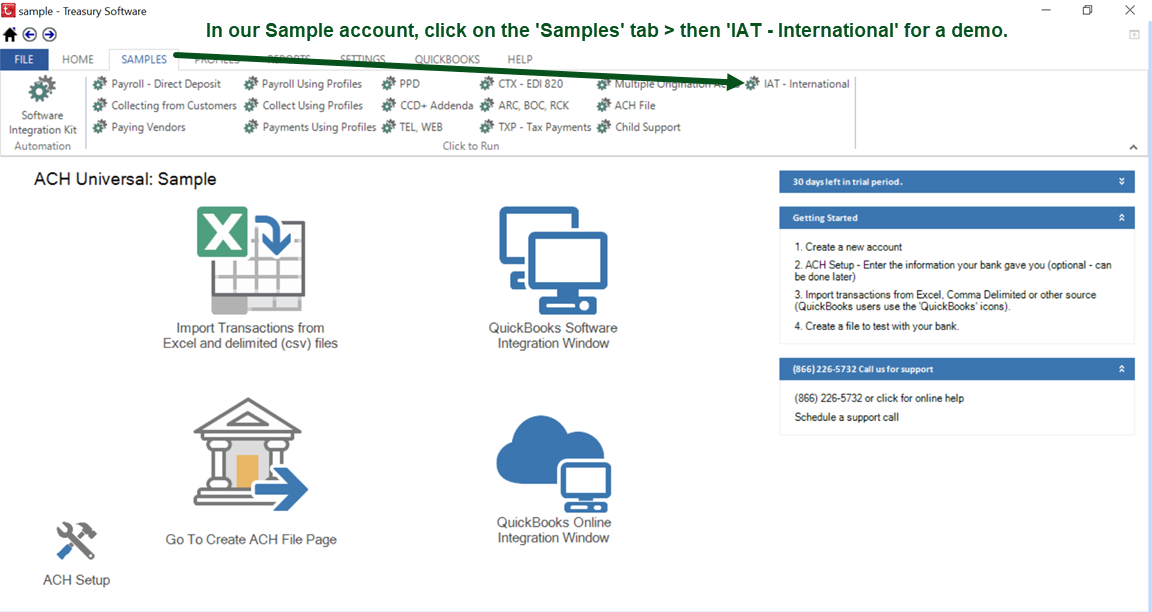

Demo

Before you get started, we recommend that you walk through our IAT sample demo.

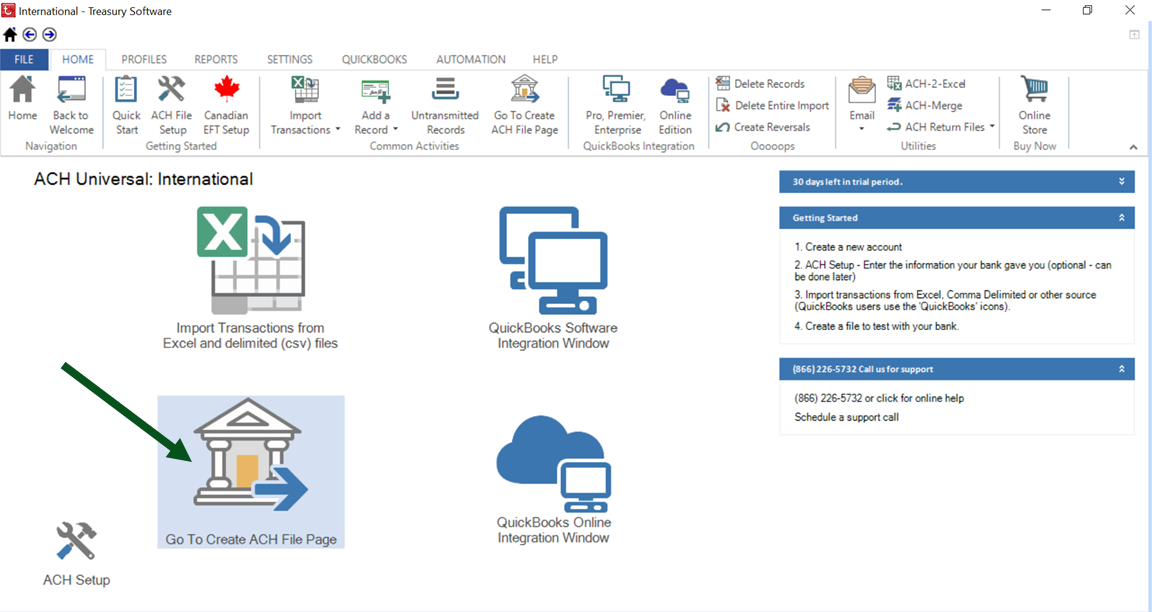

Enter into the Sample account within our software (File > Open account), then on the 'Samples' tab > click IAT - International and complete the import wizard. Then Click on the Go To Create ACH File page and click on the Create ACH File button to create the ACH-IAT file.

One-time setup

While the Sample account can be used for testing - you'll want to create a new account for production purposes. Create a new account (File > New Account) within ACH Universal - and you might want to name it 'International' or something similar to identify its purpose as this account will be used exclusively for IAT.

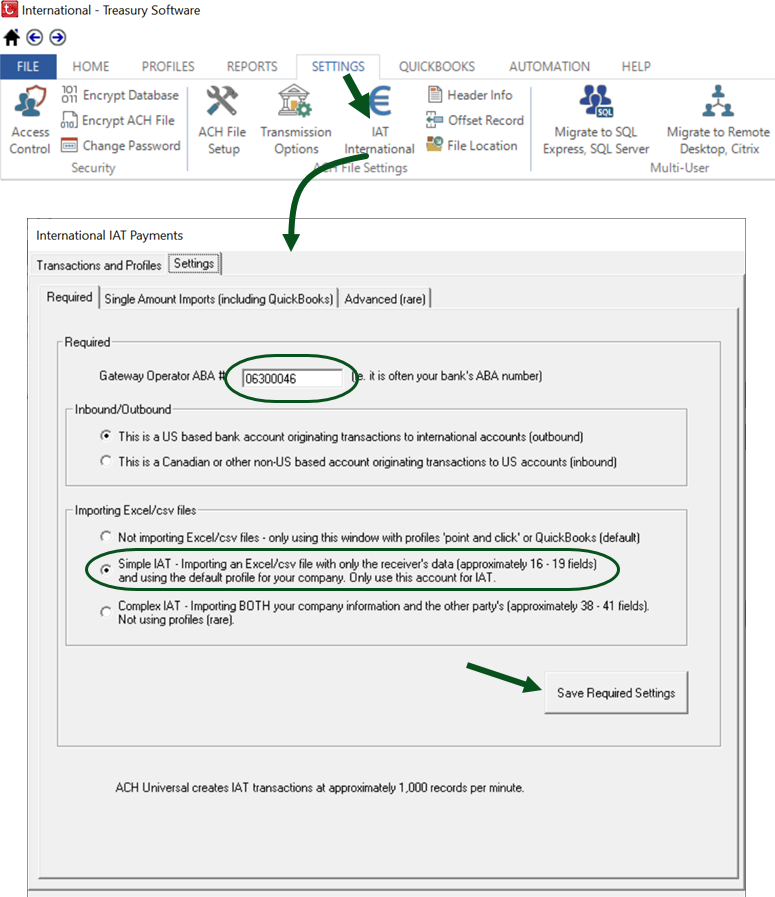

On the Settings tab, click on IAT International (see screen shot below).

On the popup window, enter your bank's gateway operator (they will supply it). If you don't have this number, use your bank's ABA routing number in the interim - as there's a good chance that this will be the number anyway.

Inbound/Outbound indicator - this identifies whether the transaction is originating in the US and instructions are being sent to a foreign country (outbound), or from a foreign country into the US (inbound).

Tip: Please remember that this is the 'flow of information and instructions' and is independent of the cash flow (debit vs credit).

For this example, select the Simple IAT import method and then click Save.

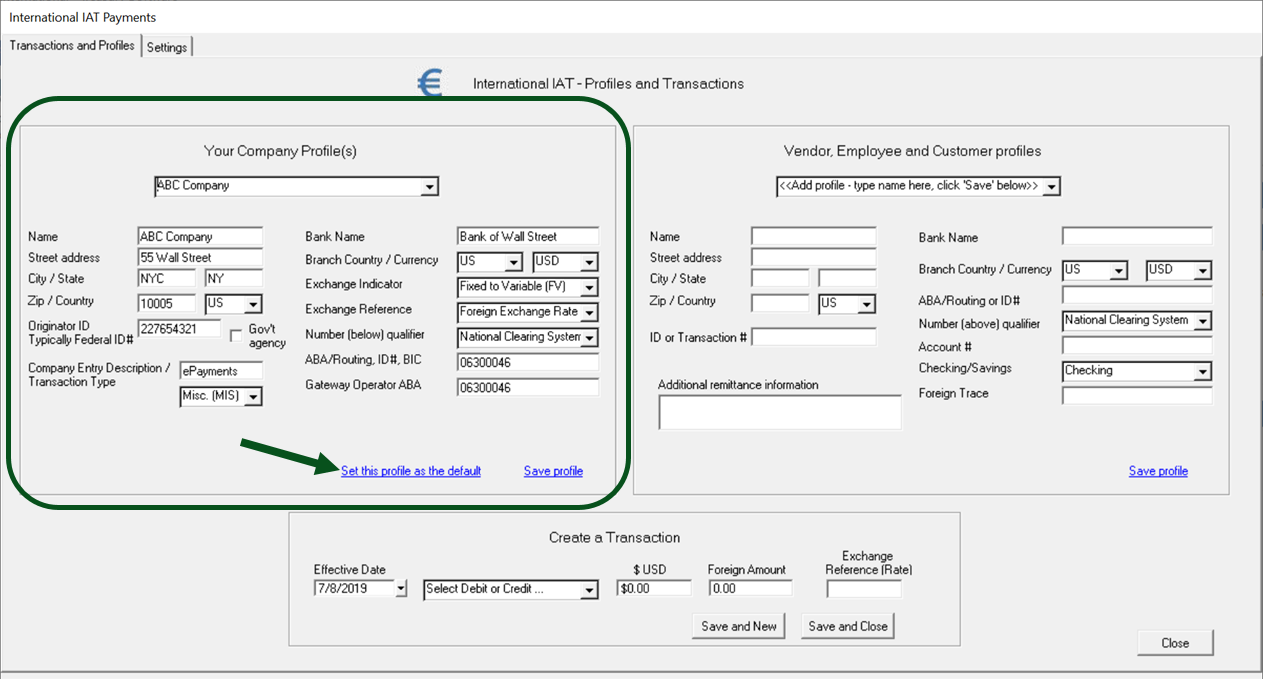

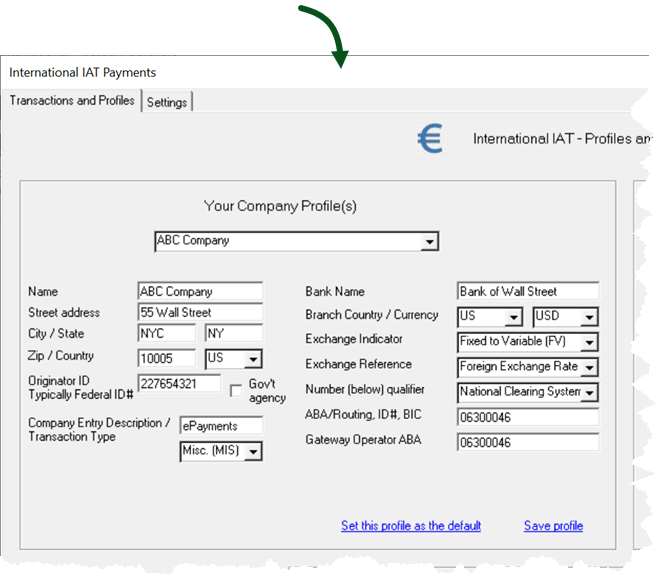

When you click on 'Save' on the settings screen, the system will switch to the Transactions and Profiles tab (below).

Here you can enter your company information on the left side.

When finished, click on the 'Set this profile as the default'.

Fields:

| Profile name |

This field at the top is for your internal use only and does not appear in the ACH-IAT file. Typically, there will be only one company profile - unless you have multiple origination accounts (ie. payroll, checking,etc...). We recommend naming the profile the same as your company name to avoid confusion. |

| Name | Your company name. This field, and all others below in this list will be in the ACH-IAT file |

| Street, City, State (Province), Zip (postal code), Country | Please enter your full address in the fields. |

| Originator ID | Supplied by your bank, it is typically a '1' followed by your Federal ID number. |

| Government Agency | Leave this checkbox unchecked, unless your organization is a governmental agency. |

| Company Entry Description | A general description of the transactions for the receiver - ie. gas bill, payroll, etc... |

| Transaction Type | Includes descriptive values such as 'SAL' (Salary), 'Tax' and 'MIS' (Miscellaneous). |

| Bank Name | Your bank's name |

| Branch Country | Country that your branch is located in |

| Currency | The currency of your bank account |

| Exchange Indicator |

Indicates the foreign exchange conversion, values include: Which code to use? |

| Exchange Reference |

The Foreign Exchange Reference Indicator describes the contents of the Foreign Exchange Reference Field and can be one of the following: 1- Foreign Exchange Rate Note: For Fixed to Fixed transactions, this will be '3' space filled, as there is no conversion. |

| The Originating DFI Identification Number Qualifier describes the type of number used below in your ABA/Routing/transit number field. 01 - National Clearing System Number 02 - BIC Code 03 - IBAN Use '01' for all US ABA/Routing Number entries. |

|

| ABA/Routing, ID#, BIC | The Originating DFI Identification number contains your bank's routing information, whether ABA, Financial Institution/Branch, BIC, IBAN, etc... |

| Gateway Operator | Supplied by your bank - and typically, your bank's routing number. |

Tip: If any of the values/entries above are not applicable to all of your transactions, you may create additional originating profiles. To use the additional profiles, switch the default profile prior to importing/creating.

When finished, click on the 'Set this profile as the default' and then close the form with the 'Close' button in the lower right corner.

Congratulations on completing your IAT setup.

Reminder: Before you send a file to your bank, set up and enter in your header information.

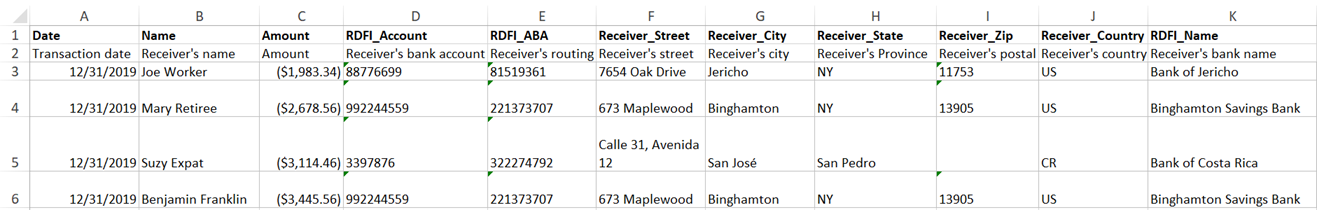

Preparing transactions to import

A sample template is provided with the software - and is available at:

C:\Users\Public\Treasury Software\Tutorial\ACHData\International-IAT-Common.xls

Details of populating the spreadsheet are at the bottom of this Help page.

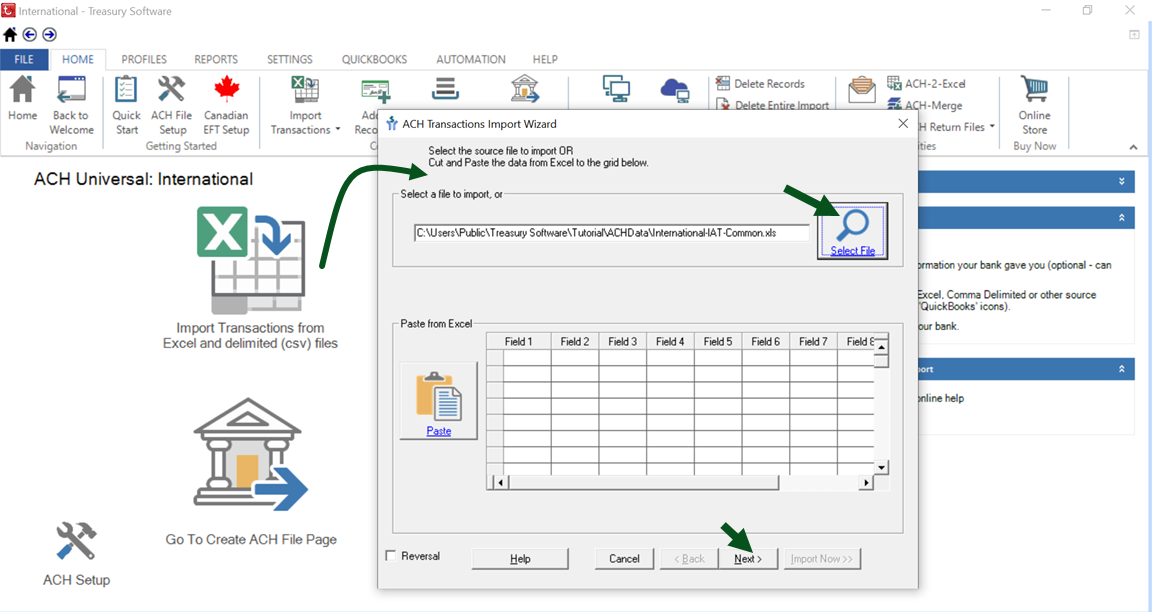

Once the spreadsheet is completed, click on the Import Transactions icon on the Home Page to start the Import Wizard. Select the file, then click 'Next'.

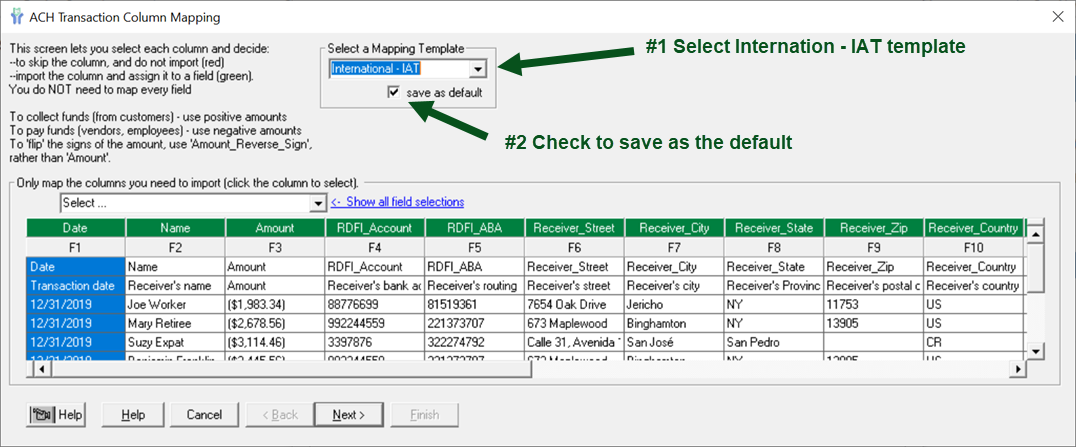

On the Column Mapping screen below:

#1 - Select the International - IAT mapping template, then

#2 - Check the box to save as the default.

Note: If you created your own template with a different field order, that is fine - this is the mapping window where you would identify/map each field. Of course, please follow our syntax and include all fields.

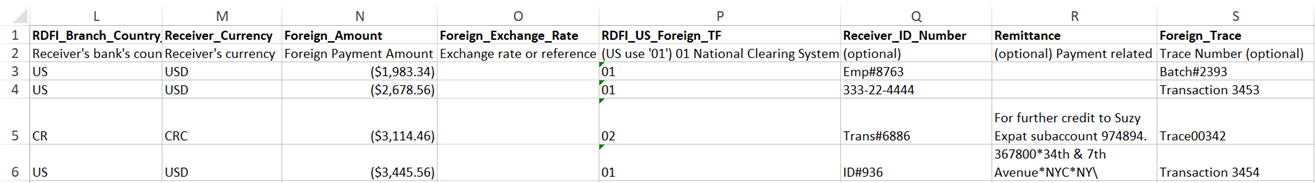

Below are fields 1 - 10.

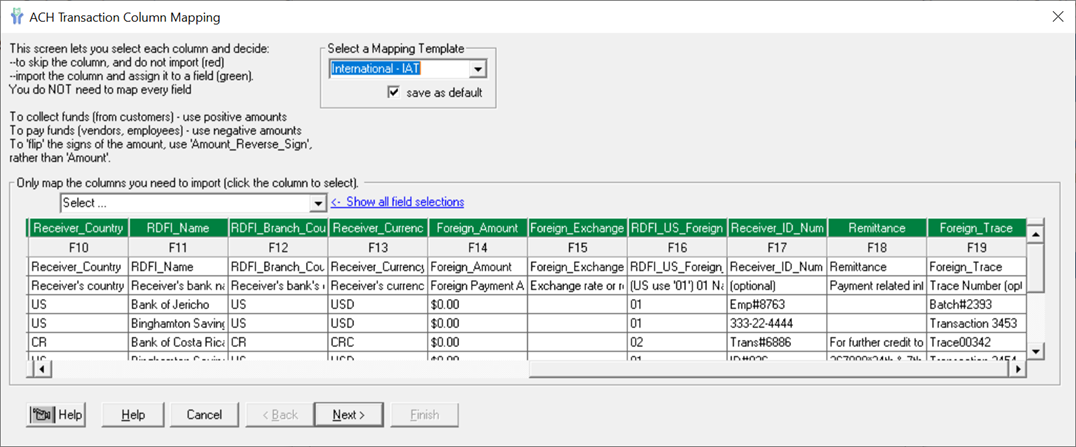

Scrolling to the right, are fields 11 - 19

Note that the first two rows in the template are:

--the name of the field where it will be mapped, and below it an

--additional description

Click Next to continue the Wizard to the Review Records screen.

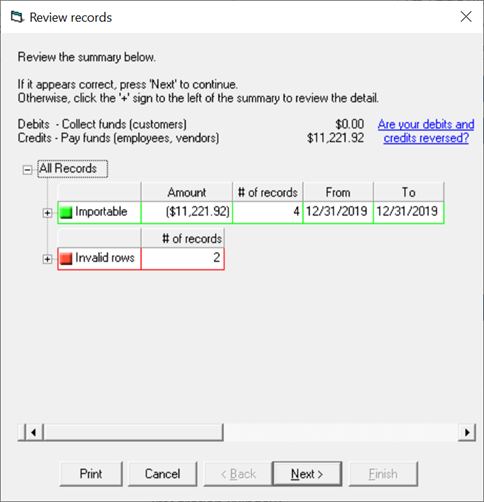

At the review records screen, you can confirm your control totals. If acceptable, click Next and then Finish.

(It is best practice to always open the Invalid Rows section to make sure there are no excluded transactions.)

Creating the ACH-IAT file

The process to create the file is the same as any other ACH file.

Click on the 'Go To Create ACH File Page' on the Home page or on the ribbon bar.

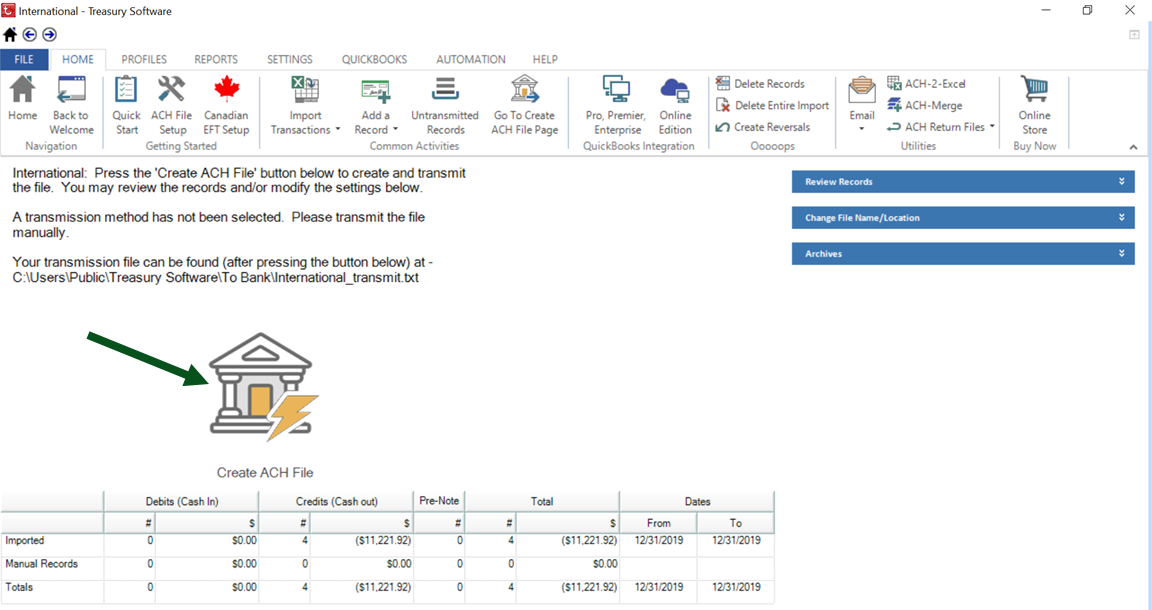

At the Create ACH File Page, you can confirm your control totals - and then click on Create when ready.

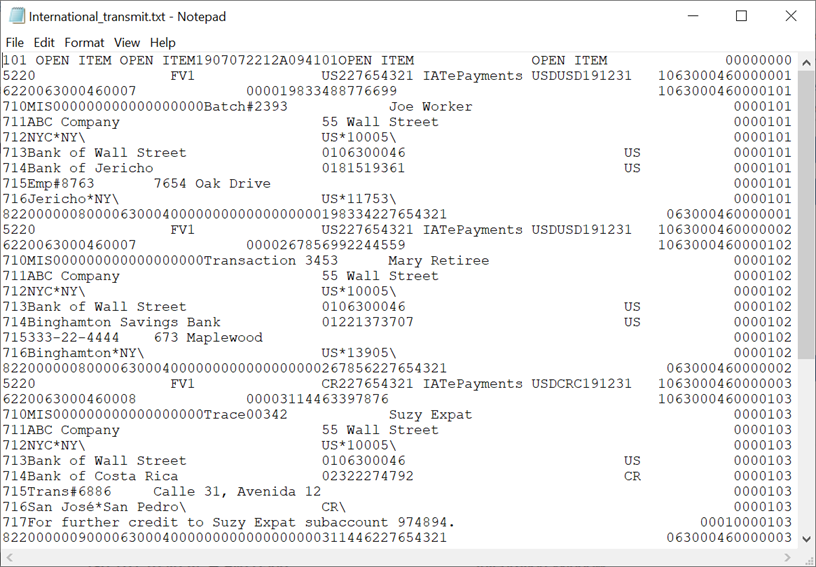

Afterwards, you'll be asked if you want to view your file (below). Click Yes.

The file is saved automatically in the software.

Transmit this file to your bank - congratulations!

Daily Usage and Operation

You will want to update the Excel file for the transactions that you want to create.

Again, this template is located at:

C:\Users\Public\Treasury Software\Tutorial\ACHData\International-IAT-Common.xls

All fields below are displayed within the ACH-IAT transaction.

Note: The field names are our mapping names (user-friendly) and are not exact NACHA field names.

| Date | Effective date |

| Name | Receiver's name |

| Amount | The value of this field is always in US dollars. |

| RDFI_Account | Receiver's bank account number |

| RDFI_ABA | Receiver's ABA, routing, branch/transit, BIC or IBAN number |

| Receiver_Street | Receiver's street address |

| Receiver_City | Receiver's city |

| Receiver_State | Receiver's state or province |

| Receiver_Zip | Receiver's zip / postal code |

| Receiver_Country | Receiver's country (use ISO 2 digit abbreviations). US (US), Canada (CA), Mexico (MX). See our IAT profile form to lookup other countries. |

| RDFI_Name | Receiver's bank name |

| RDFI_Branch_Country_Code | Receiver's bank's branch country (use ISO 2 digit abbreviations as noted above) |

| Receiver_Currency | Receiver's currency (use ISO 3 digit abbreviations). US (USD), Canada (CAD), Mexico (MXN). See our IAT profile form to lookup other currencies |

| Foreign_Amount |

The amount entered is determined by whether a transaction is outbound (originating in the US) or inbound (originating in a foreign country) - and the exchange indicator (FF, FV or VF) |

| Foreign_Exchange_Rate | Exchange rate or reference FF - leave blank FV, VF - enter rate or another reference (contact your banker) |

| RDFI_US_Foreign_TF |

Receiving DFI Identification Number Qualifier |

| Receiver_ID_Number (optional) | You may insert your own number (ie. Vendor #, Employee #, etc...) |

| Remittance (optional) | Payment related information and to help identify for future credit the ultimate beneficiary or foreign party. |

| Foreign_Trace (optional) | Trace number in a foreign system. Not ACH trace number. |

| Checking_or_Savings (optional) |

Used in helping determine the transaction code. Defaults to checking/demand account. Used to identify receiver's account. ACH Universal valid entries are |

Knowledge of IAT - Full demo in our Sample account

The IAT format is a fairly complex format compared to other formats, such as CCD and PPD.

Feel free to use our 'Add a Record' interface in our Sample account, which can walk you through the process.

If you are not familiar with the IAT format, we recommend that you contact your banker or NACHA.org for additional resources.

Map all fields!

All fields noted are required to be mapped, even if they are empty (blank), or of $0.00 amount.

Failure to import all of the fields may result in the inability of ACH Universal to create a proper transaction; while other omissions may allow the transaction to be created, but ultimately the file may be rejected by the NACHA network.