To change the effective date on your ACH file, there are several different ways this can be done, depending on how you bring in data to ACH Universal:

1. If you are using QuickBooks:

You can change the date of your checks to the date you want the effective date to be (generally the date bills are paid or payments received) or you can change the date to be the 'Next Business Day or Later'. This will automatically date the file for the next business day--unless a later date is used in QuickBooks for payments or collections.

Note: Treasury Software knows weekends but does not know holidays. Please be sure to avoid dating your file on bank/Federal holidays or it could be rejected.

----------------------------------------------------------------------------------------------------------------

2. If you are using QuickBooks Online:

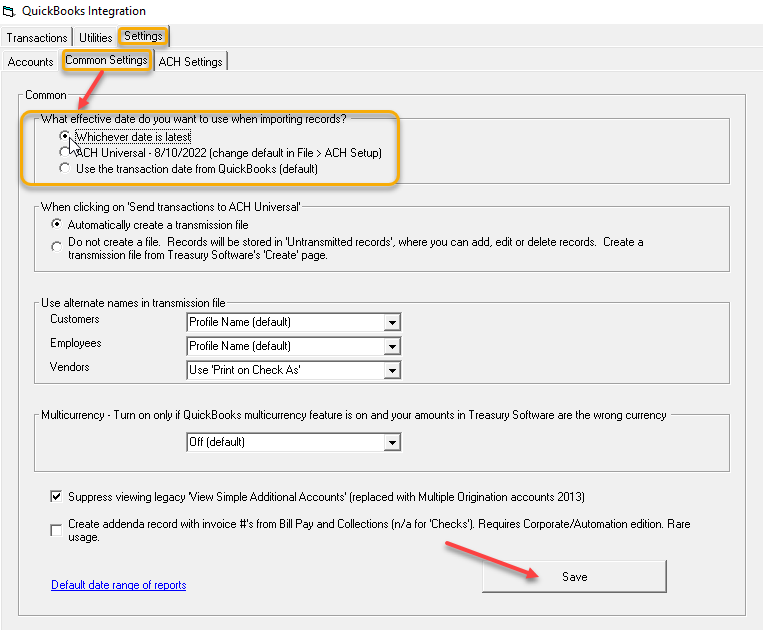

If you are integrating with QuickBooks Online, you also have a 'Settings >Common Settings' tab to change the file date, with the same options as QuickBooks Desktop above.

-----------------------------------------------------------------------------------------------------------------

If you are importing an Excel or CSV file:

There are two ways to change the date on your file.

3. You can go into your ACH Setup wizard that is on your main screen:

Click through to Screen 5 of 7 (choosing 'Advanced Setup' options) and then select the effective date you want using the dropdown on the right side. Then click Next, then Next again, and Finish. Once you change it, you are changing the default for the software going forward, and may need to change it again.

4. If you are importing data via an Excel or CSV file and you include a (mapped) 'Date' column when importing, the software will use that date as the effective date; it will override the system date.

If a 'Date' column is not mapped, the system date will be the next business day's date.

|

Name |

Routing No |

Bank Acct No |

Amount |

CHK/SAV |

Date |

|

Mary Smith |

054001220 |

321321654 |

$ (1,250.00) |

C |

2/3/2022 |

|

John Smith Inc. |

121000248 |

654654987 |

$ (4,587.00) |

C |

2/3/2022 |

| [overrides] |