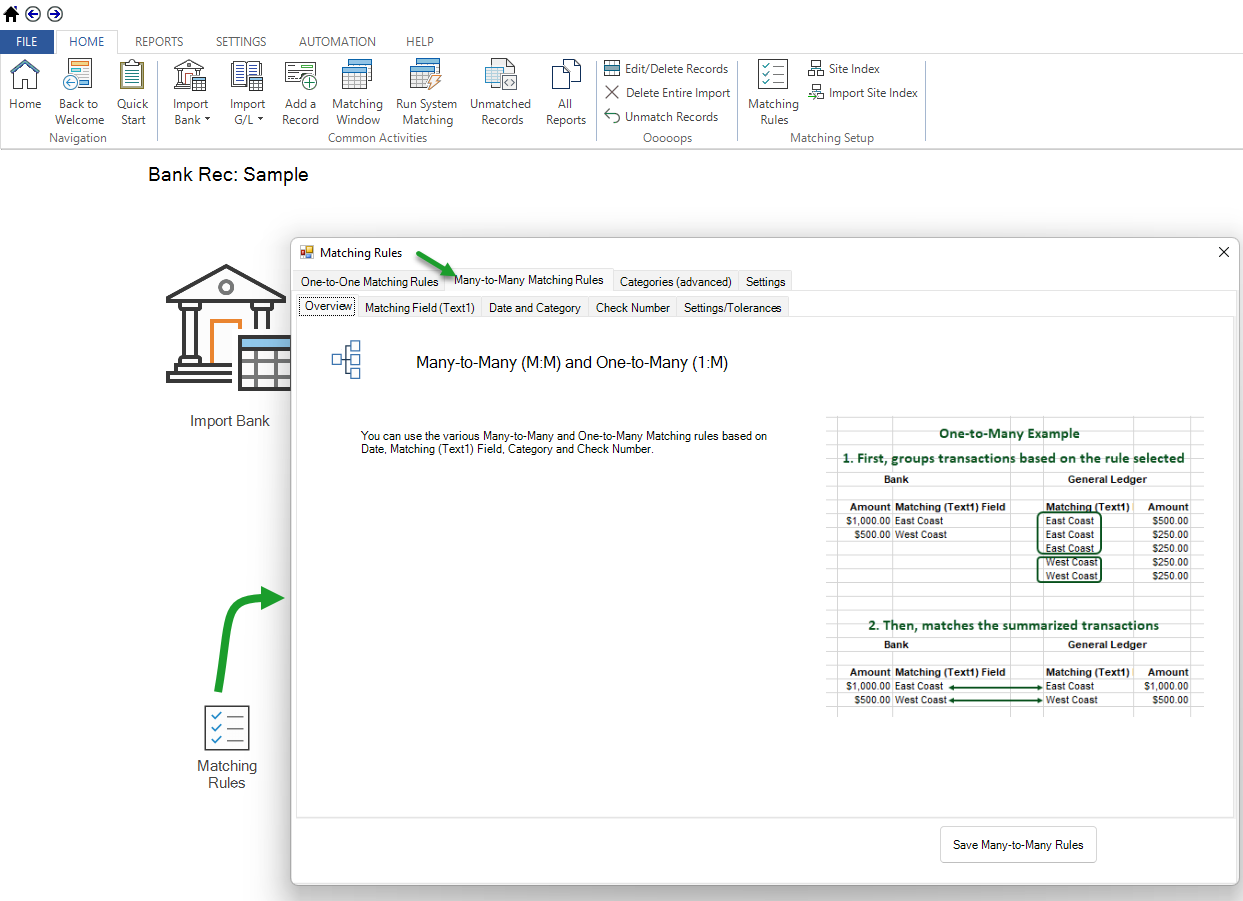

Overview

The system comes with predefined high speed many to many rules:

- Alphanumeric Matching (Text1)

- Date and Category

- Check Number

Check the rules you want turn on.

These rules are run after the one to one matching rules.

When we refer to many to many matching, we are also referring to one (Bank) to many (G/L) rules.

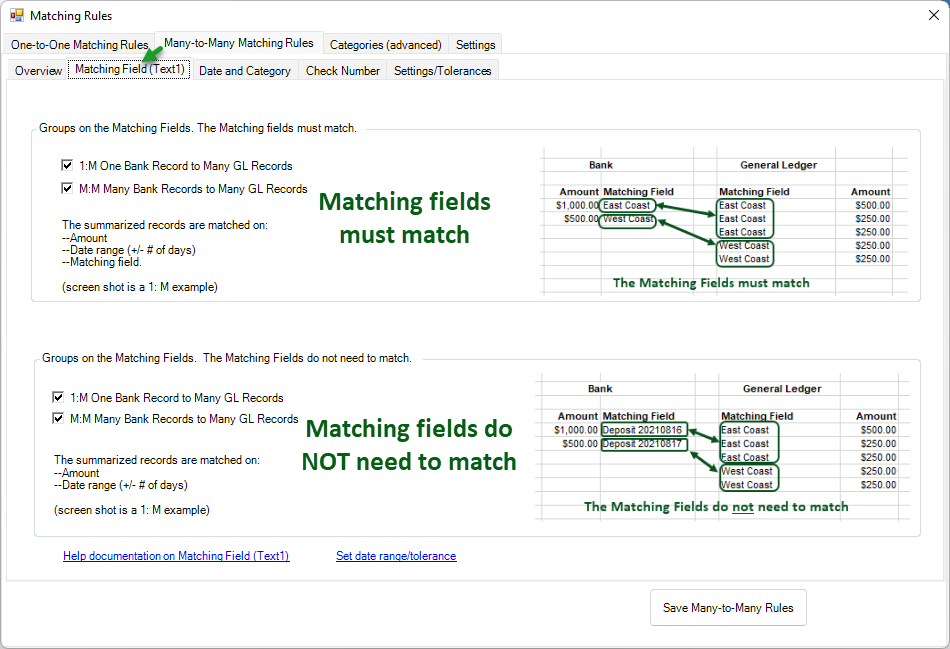

Based on Matching Field (Text1)

Sums the unmatched non-check Bank records by the Matching Field (Text1).

Sums the unmatched non-check GL records by the Matching Field (Text1).

Then, attempts to match the summarized Bank and GL records based on:

Bank Sum(Amount) = GL Sum(Amount)

Bank Matching Field = GL Matching Field (top section only)

The system uses:

Date Tolerance

Date tolerance # of days (the two dates can be up to this many days apart).

Note: The date is defined as the latest date within each summarized group of records. If you prefer not to use this tolerance, set the number of days to 999/-999 in settings.

Notes:

If One to One matches are also expected, we highly recommend also enabling the one to one matching rule.

This routine does not use the date as an attribute. The date range between the two summarized records are not taken into account.

These routines will attempt to match non-check records only. Non-checks are those records where the check number is 0.

This rule will include site as an attribute if site is turned on.

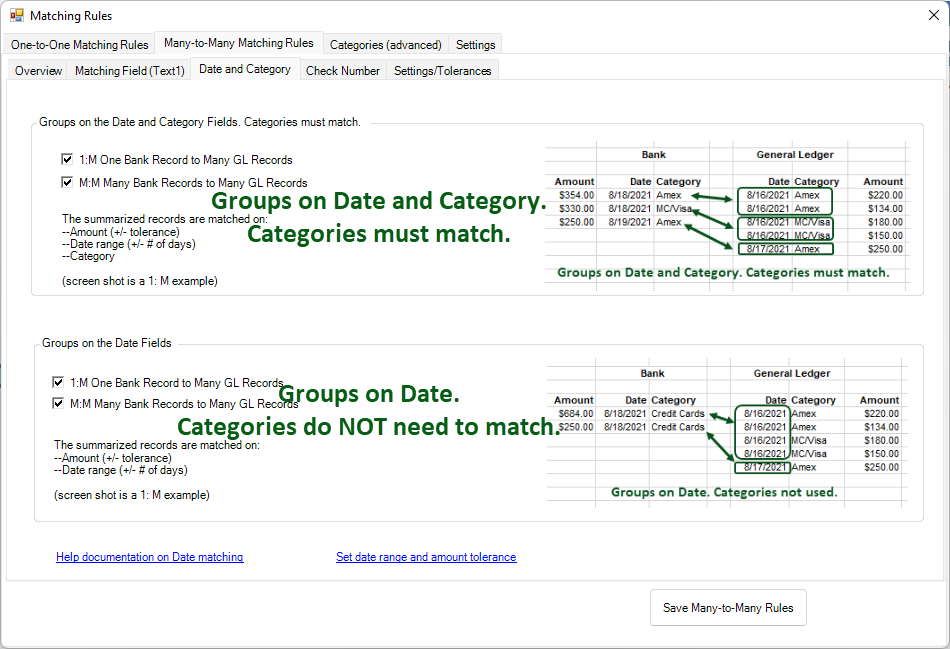

Based on Date and Category

Sums the unmatched Bank records by Date, and Category (top section), if used.

Sums the unmatched GL records by Date, and Category (top section), if used.

Then, attempts to match the summarized Bank and GL records based on:

Bank Sum(Amount) = GL Sum(Amount), and

Bank Category Type = GL Category Type (top section only)

Notes:

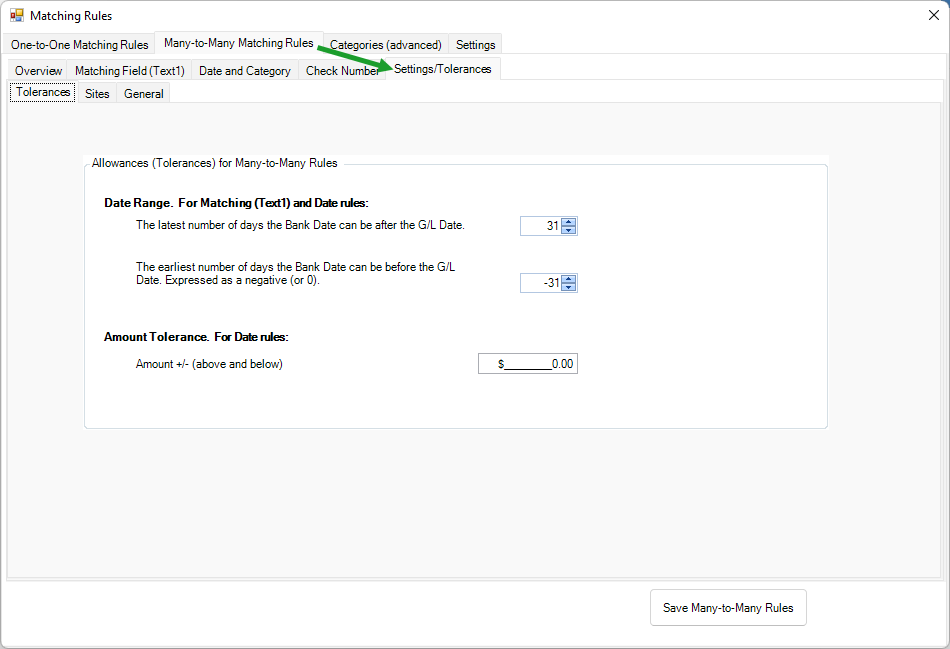

The system uses two tolerances:

Date Tolerance

Date tolerance # of days (the two dates can be up to this many days apart)

Amount tolerance

Amount tolerance (the two amounts can be up to this amount difference).

If the summarized records are not equal in amount - but within both tolerance ranges, a match will be made and a GL entry will be created for the offsetting amount to keep the system in balance.

Will group by site number and require Bank Site Number = GL Site Number in the match if site number is turned on.

Use: This routine is anecdotally referred to as the credit card and C-store (convenience store) routine.

It is often used when a batch payment is received from the credit card processor and GL records are in transaction detail. Set the date allowance to allow for long holiday weekends and the rounding amount tolerance for fees (if any).

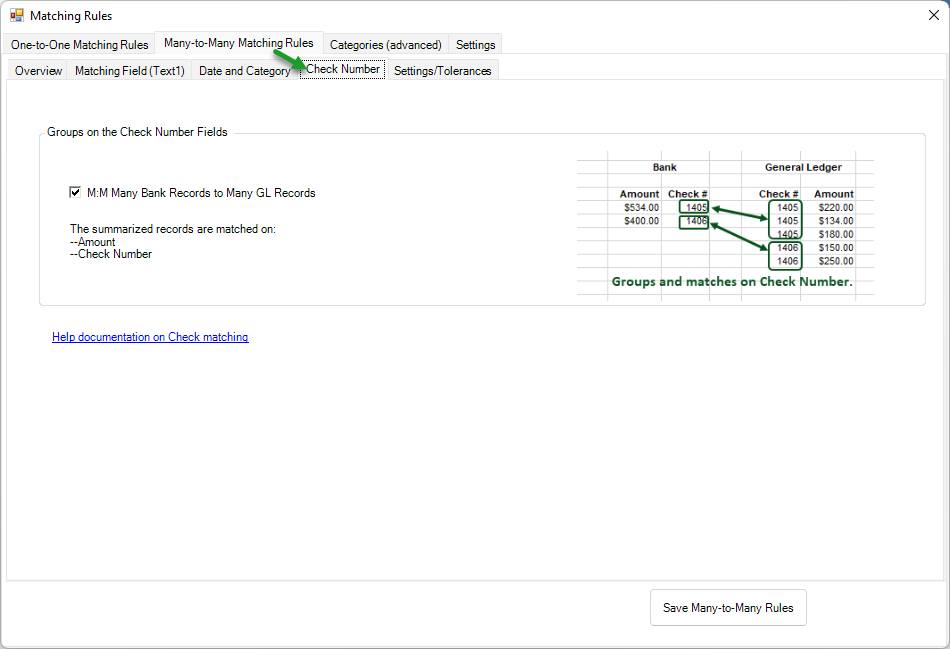

Based on Check Number

Sums the unmatched Bank records by Check Number.

Sums the unmatched GL records by Check Number.

Then, attempts to match the summarized Bank and GL records based on:

Bank Sum(Amount) = GL Sum(Amount), and

Bank Check Number = GL Check Number

While it will also accommodate One:One matches, we recommend also enabling the Check matching rule.

Notes: Typically used when the GL check detail is broken into multiple lines by line item detail or when using as a 'paymaster' (broken out among intercompany entries). Used in some Peachtree accounting reconciliations.

Settings